Non-Fungible Tokens (NFTs) are a special class of tokens, which can be traded but cannot be exchanged as these are digital assets and each NFT is different from another.These are not like cryptocurrencies such as Bitcoin. The value of one Bitcoin is exactly the same as the value of any other Bitcoin since it is fungible.

An NFT establishes its market value depending on what is in demand or what customers are ready to pay for it, and two different NFTs cannot be exchanged for each other. The best analogy of what an NFT represents is coming from the art world. A work of art, such as a painting, is non-fungible, since each painting is unique.

Fraudsters can take advantage of it by selling or purchasing NFTs without providing any identity document. Fraud in NFT trading is a serious problem, and in this article we discuss how KYC and digital identity documents can solve it.

Digital Identity Document Verification

The responsible art market (RAM) was established in Geneva in the year of 2015. Its purpose was to prevent worldwide money laundering and illegal financing through artwork businesses. The organization plays the role of streamlining the complete auction places, art industry, and galleries linked to this industry.

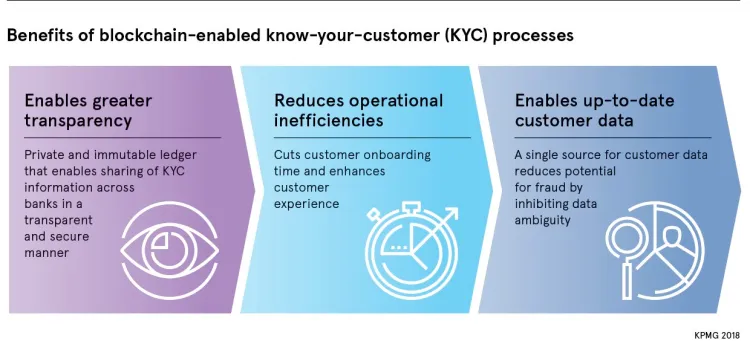

Every art stakeholder must comply with Know Your Customer (KYC) compliance in order to validate the identity document checking process of customers before the onboarding procedure. In addition, they must manage all of the records using transaction monitoring systems. Record keeping and document check are also very important in order to save the globe of arts and artists.

Organizations, such as cryptocurrency exchanges, always ask for identity proof from new customers before the process of onboarding. Every company must follow the procedure in order to protect itself from identity fraud and money laundering. Recent surveys reveal that fraudsters use forged IDs in order to launder their money for illicit purposes.

Therefore, the complete verification of new customers is essential for organizations dealing in finance and crypto. Businesses use Know Your Customer (KYC) and Customer Due Diligence (CDD) procedures for effective and efficient authentication. These are complete operations that evaluate each and every aspect of their customer’s genuineness and analyze their identity.

How Fraudsters Use NFTs as a Tool for Money Laundering?

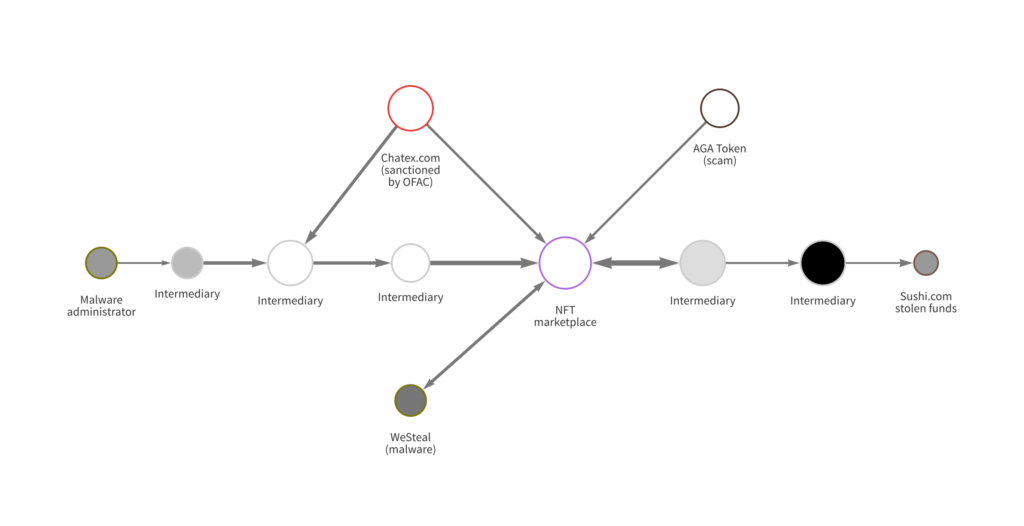

Fraudsters find it an attractive place due to the lack of government regulations and easy access to digital collectibles. The exchange of cash into a digital asset is more challenging to trace. Bitcoins can easily be utilized for money laundering as it is not present physically. Additionally, law enforcement finds it more challenging to find out the NFTs’ owners while using unknown accounts. It is a problematic task to link these accounts to the actual user.

Fraudsters can move a lot of money as the quantity of information is not restricted when purchasing or selling NFTs without document checking. Furthermore, the true source of cash can also be hidden by the fraudsters if they use cryptocurrencies like bitcoin while purchasing or selling NFTs. Therefore, the implementation of identity document verification is a must.

NFT Buyers and Sellers: Document Verification Process

The major challenge coming from NFTs in this regard, is the lack of central authority or regulation, as it pretty much happens with cryptocurrencies such as bitcoin. Due to the potential of being used for money laundering, they are coming under great scrutiny. That’s not to say that the majority of NFT trading is used for money laundering, but it’s possible that certain individuals or organizations might be using it this way.

The transactions of NFTs are anonymous, as they are mostly made using cryptocurrencies. Some exchanges require extra measures such as KYC in order to confirm customers’ identity, while others do not. The cryptocurrency exchanges are designed in such a way that they don’t require online identity document authentication in which the assets trading with NFT are possessed by both parties.

Conclusion: Fraud in NFT trading

AML and KYC procedures help in address fraud in NFT trading and other crimes within the financial industry. These crimes include money laundering, corruption, tax evasion, terrorism sponsorship, etc., through which fraudsters engage in criminal activities and try to gain their evil goals.

The financial industry is assisted by the law to find and recognize the identity document verification of customers in order to prevent these illegal activities. In addition, companies that operate in this space must make sure that the customer’s money is not obtained through illegal means or used for criminal operations. It is where AML and KYC come into play, enabling online document verification of customers’ IDs and financial activities.

Anti-money laundering and Know Your Customer policies are essential for industries and individuals engaging in Non-Fungible Tokens (NFTs) as they ensure that all the transactions are connected to a legitimate company or a person. Online identity document verification provides an effective and efficient solution to instantly verify a customer’s ID, streamline the process of onboarding and satisfy compliance requirements by utilizing advanced developments in biometrics, video, and data analysis.

Wanna become a data scientist within 3 months, and get a guaranteed job? Then you need to check this out !