The internet has significantly transformed over the years and continues to evolve. We are now on the brink of entering a decentralized digital world with Web3, which promises infinite possibilities. Web3 could revolutionize how we interact with technology, from secure data storage to effortless online payments. This could be a game-changer for the digital world, and we are here to witness it in all its glory.

Web3 is set to revolutionize the internet as we know it, providing a decentralized network where data and digital assets can be securely exchanged and accessed without the need for a middleman.

This new technology grants users greater control over their data, enables businesses to access services that were previously limited to large corporations and allows developers to create powerful applications that weren’t possible before. Web3 is the future of the internet and is sure to have a profound impact on the way we interact with the digital world.

Web3 technology has revolutionized the way companies operate in banking & finance, and health care, providing lower-cost solutions with greater transparency than traditional institutions.

This technology has enabled developers to create innovative and efficient decentralized applications (dApps) with significantly reduced overhead costs, thanks to the introduction of blockchain oracles. This has made it much easier for companies to carry out their operations in a cost-effective manner, with a greater level of transparency than ever before.

This article will help you understand the impact of Web3 on decentralized applications. The global Web3 blockchain market was valued at $1.73 billion in 2022 and is expected to witness a CAGR of 47.1% from 2023 to 2030. Thus, now is the right time to invest in dApp blockchain application development for your future if you wish to leverage this growing digital ecosystem.

Understanding the Role of Web3 in the Future of Decentralized Applications

Web3’s decentralized model has the potential to revolutionize the way we utilize the internet, offering a new level of autonomy, security, and efficiency. The technology can disrupt existing business models across industries, providing users with unprecedented control over their data and digital assets. This could lead to a more equitable and democratic economic system where individuals have the power to shape their own digital future.

Gartner has predicted that Web3 technologies will become widespread within the next decade. Furthermore, it is estimated that by 2024, 25% of businesses globally will have integrated their existing applications and services with decentralized Web3 applications. This indicates that the future is rapidly approaching and that the implementation of Web3 technologies may be closer than we expect.

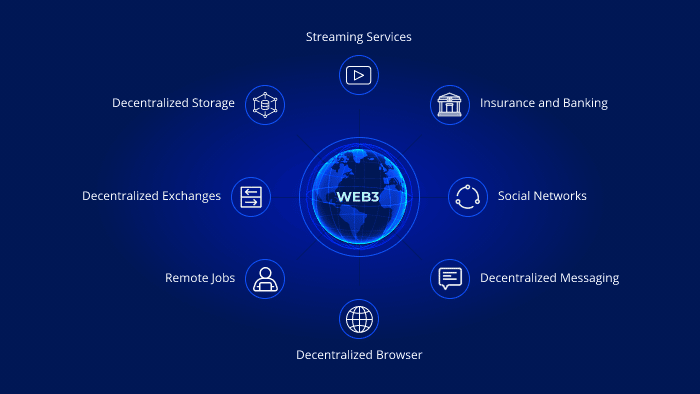

In this article, we will explore major use cases of Web3 that will make an impact on the future of the economy and discuss the importance of businesses adapting to this technology.

Major Use Cases of Web3 that will Reshape the Global Economy

1. Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is a burgeoning model that is steadily gaining momentum in the financial services sector. It is based on distributed ledger technologies, such as blockchain, which have the potential to replace or augment services offered by traditional financial institutions. DeFi allows for multi-party transactions to be processed quickly and securely on decentralized applications (dApps), providing a more efficient, transparent, and secure way of conducting financial activities.

The benefits of DeFi are numerous and include:

- Improved access to financial services: DeFi offers banking and investment services to individuals and businesses that may have been traditionally underserved by the conventional financial sector. This can help bridge the gap in financial inclusion for those who have limited access to banks and other financial institutions.

- Lower transaction costs: By reducing the need for intermediaries and enabling peer-to-peer transactions, DeFi can help lower the transaction costs associated with traditional financial services, such as remittances, lending, and asset management.

- Enhanced security and privacy: DeFi leverages cryptographic techniques and decentralized infrastructure to provide a higher level of security and privacy for users, reducing the risks associated with centralized systems that are vulnerable to hacking, fraud, and data breaches.

- Programmable finance: DeFi enables developers to build smart contracts that automate financial processes, such as collateralized lending, interest rate swaps, and tokenized assets. This programmability can lead to more efficient, customizable, and innovative financial products and services.

- Interoperability and composability: DeFi applications are built on open protocols and standards, allowing them to interact seamlessly with one another. This fosters innovation by enabling developers to create novel financial products and services by combining existing DeFi building blocks.

2. Digital Payments via Cryptocurrency

Digital payments via stablecoins or cryptocurrencies are rapidly gaining popularity as a viable alternative to traditional payment methods. A recent Deloitte report found that nearly three-quarters of retailers surveyed intend to accept such payments within the next two years. This growing acceptance is likely driven by several factors:

- Consumer demand: The increasing interest among consumers in using cryptocurrencies for everyday transactions is prompting retailers to adopt Web3 point-of-sale solutions, such as XPOS Web 3.0. As more people invest in and use digital currencies, businesses must adapt to accommodate these new payment methods to remain competitive.

- Enhanced security: Cryptocurrency payments leverage blockchain technology, providing enhanced security through cryptographic techniques and decentralized transaction validation. This reduces the risk of fraud and chargebacks, offering both consumers and merchants a more secure payment option.

- Faster and cheaper cross-border transactions: Cryptocurrencies enable faster and more cost-effective cross-border transactions compared to traditional banking systems, which often involve high fees and lengthy processing times. This makes digital currencies particularly attractive for international trade and remittances.

- Reduced reliance on intermediaries: Cryptocurrency payments often bypass the need for traditional financial intermediaries, such as banks and payment processors, reducing transaction costs and allowing for greater financial independence for both consumers and businesses.

- Integration with Web3 solutions: As businesses continue to adopt and integrate Web3 solutions into their operations, incorporating cryptocurrency payments becomes a natural progression. These digital payments can be easily integrated with decentralized finance (DeFi) platforms, smart contracts, and other blockchain-based applications, further enhancing the capabilities and offerings of businesses in the Web3 ecosystem.

The development and adoption of Web3 point-of-sale solutions, such as XPOS Web 3.0, announced at the 2022 Singapore Fintech Festival, are just the beginning of a broader shift toward digital payments via cryptocurrency. As more businesses embrace Web3 technologies and consumers continue to demand innovative, secure, and convenient payment options, we can expect to see the use of digital currencies for everyday transactions become increasingly commonplace.

3. Decentralized Autonomous Organizations (DAOs)

Web3 has the potential to revolutionize governance models through the implementation of decentralized autonomous organizations (DAOs). These blockchain-based systems are owned and managed by their stakeholders, allowing for a more democratic and transparent approach to decision-making and resource allocation. DAOs have the potential to transform governance models in various ways:

- Enhanced transparency: DAOs enable stakeholders to view and verify transactions and decisions made within the organization, promoting a higher level of trust and accountability compared to traditional corporate governance structures.

- Distributed decision-making: By leveraging token-based voting systems, DAOs allow stakeholders to have a direct say in the organization’s decisions, fostering a more collaborative and equitable decision-making process.

- Reduced bureaucracy: DAOs can automate various administrative tasks using smart contracts, leading to a more efficient and streamlined organization with reduced overhead costs and fewer bureaucratic bottlenecks.

- Scalability and adaptability: DAOs can be easily scaled or restructured as needed, thanks to their modular and decentralized design. This adaptability enables DAOs to quickly respond to changes in their environment or industry, providing them with a competitive advantage.

- Innovative use cases: DAOs can be applied to a wide range of industries and sectors, as demonstrated by the example of a DAO in Melbourne, Australia, that is currently being developed to help revitalize certain areas of the city. This highlights the versatility of DAOs and their potential to drive innovation across various domains.

Furthermore, non-fungible tokens (NFTs) are being utilized in the media world to allow artists to control their digital creations on a blockchain and share them directly with their audience. This empowers creators and fosters a more direct relationship between artists and their fans. To successfully navigate the disruptions and opportunities presented by Web3 technologies like DAOs and NFTs, businesses must proactively adapt their strategies and operations. This involves partnering with a dedicated mobile app development company in New York, a Web3 solutions provider, or an enterprise-grade blockchain platform to develop digital assets and deploy them on decentralized applications (dApps). It is also crucial to ensure that teams, from leadership to developers, are properly trained and upskilled on Web3 and its applications. By staying informed and prepared for the ongoing advancements in Web3 technologies, businesses can capitalize on the potential of DAOs, NFTs, and other decentralized innovations to drive growth and success in the digital age.