As some of you might know, I have done lots of work in the space of tokenomics. I was one of the early proponents of agent based modelling, and have done lots of work in valuations.

Tokenomics has evolved a lot since the ICO boom of the 2017, with Decentralised Finance (DeFi) being one of the prime movers of evolution of tokenomics.

1st generation tokenomics

The first generation of tokenomics was based mostly on what is called utility tokens. A utility token is a token that can be used within a platform to do certain things. The traditional way that companies would go about tokenomics during the ICO boom would be:

- Create a project that requires the use of a utility token.

- Run an ICO

- People buy into the ICO, with the hopes that the utility token will appreciate as a result of a large number of users finding the project attractive.

One of the best projects of that era is Filecoin, which is a decentralised file storage project.

Another very promising project is Steemit. Unfortunately, its tokenomics were interesting in principle, but failed to work well in practice. Steemit rewards content creators with newly minted tokens. Hence, the price of the token is inflationary, and this pushes the price downward. The effects of this can be seen on the chart below.

One of the most common mechanisms of that era was to simply have a fixed supply, so as tokens would be burned, they would increase in value. In practice, this was a very bad idea for most projects, since it didn’t explain how this would be sustainable in the long run. Plus, many projects failed to really justify why they needed to use a utility token. This led to the failure of many projects, and in combinations with regulation, killed the ICO craze of 2017.

2nd generation tokenomics

One of the things that define 2nd generation tokenomics is increased sophistication. Many 1st generation tokenomics projects were simply using utility tokens as a replacement for fiat. This is something I had written about in the past, as many projects were simply trying to find excuses to push business models towards ICOs.

However, second generation tokenomics do not shy away from taking advantage of blockchain’s unique capabilities. I think there are some interesting themes amongst many projects of 2nd tokenomics designs, some of which are discussed below. If I would have to summarise 2nd generation tokenomics and their mechanisms in a few points, these would be the following:

- 2nd generation tokenomics are opening up to both new and more sophisticated users, through the implementation of multiple mechanisms.

- 2nd generation tokenomics are more aware of balancing supply, demand, inflation and deflation. 1st generation tokenomics were often based on the idea that users will join a platform, and this will help boost the price (without any foresight as to how this will work in the future). 2nd generation tokenomics implement various mechanisms in parallel to ensure that the economy can grow in a stable rate.

Staking

Staking has existed since the early days of blockchain. However, this mechanism is now becoming more and more popular. With Ethereum 2.0 adopting proof-of-stake, the idea of staking has now become mainstream.

When a user is staking tokens, they are prevented from using them for a certai period in time, but they are rewarded with new tokens. For example, Ethereum competitors, Polkadot, and Cardano are following a similar mechanism.

Ethereum is using this mechanism within the context of a proof-of-stake blockchain. However, staking can be used in many other contexts, outside of proof-of-stake. For example, in DeFi users are incentivised to lend their tokens and then receive yield. This can be seen as a form of staking, since the tokens are locked during that period.

Two-token designs

A two token system is utilising two tokens within the same economy. The tokens are linked with each other through incentives and other mechanisms, and in certain cases there can also be some mechanisms which peg the price in certain ways.

A very good example of a great two-token design is Terra and Luna. In this case, the two token design is used in order to stabilise the price.

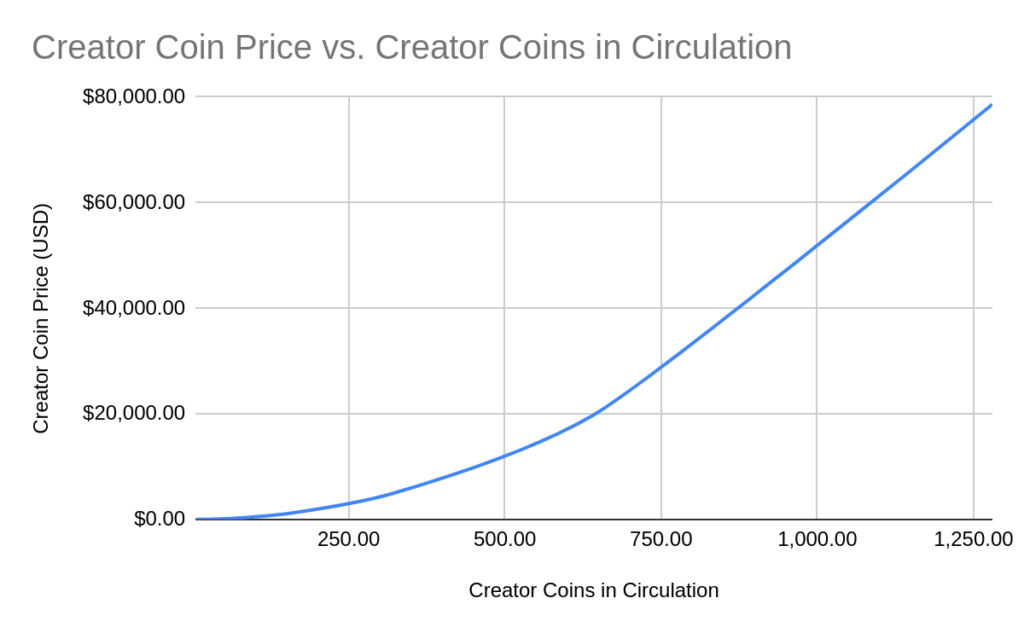

Another example where a two-token system was used is Bitcout. Bitclout is like a Twitter on blockchain, focused heavily on NFTs and creatives. Within the Bitclout ecosystem, every account get their own creator coin. You can invest in users creator coins, and the more people invest, the more the coin increases in value according to a certain curve (show below).

Bitclout received a huge boost in popularity when it launched, before crashing. There are many concerns that play a role in the success of a crypto project, but in any case the tokenomics design of Bitclout is fairly interesting. I think one of the main benefits of the design, which are outlined in Bitclout’s documentation is that this design opens up many different use cases.

By the way, if you check this project out, also please make sure to check eyeXmachina’s page, which is an AI art and NFT collective I am part of :).

Finally, there are some other topics that define the 2nd generation of tokenomics, like governance, which we will cover in other articles.

Summary: The future of token economies

Designing a good token economy is no easy task. When tokenomics started out we saw many projects making the mistake of simply using utility tokens as a replacement for fiat money. As years went by, token economies have grown more complicated.

An important realisation is that irrespective of the actual mechanisms involved, a token economy has to satisfy the following constraints:

- Make sure that at least one token (if we are talking about a multiple token economy) provides value which cannot be found in fiat money.

- Make sure that at least one token appreciates in value.

- Value appreciation happens in a sustainable manner, it is not simply based upon burning tokens making the project look like a giant Ponzi scheme.

- Allow for many different use cases within the same system, e.g. like Bitclout (now called Diamond App) is doing. This allows tokenomics to play a role in discovering product-market fit.

I think that tools like agent based modelling will keep playing a key role in designing and developing token economies. I also believe that the increasing popularity of the DeFi space will be one of the key drivers of the design of new token economies. So, the future looks exciting!

- State of the cryptomarket: Celsius, Three Arrows, Voyager Digital and the future of decentralisation

- Announcing the new data maturity short course with Sameer Rahman and the Tesseract Academy

- Neural networks tips and tricks

- Understanding the Risks: A Deep Dive into the Vulnerabilities of Smart Contracts