Token economics 101

Tokenomics is the study of token usage and the effects of a token’s design on its economics. Tokenomics is an important part of many blockchain projects because it ensures that the project has a sustainable business model that will make it profitable in the long-term.

The objective of a good token economy is to create a system that benefits all parties involved, not just one party or group of parties. This can be done by incentivizing certain behaviors or punishing others through economic mechanisms like incentives and disincentives, which are often built into smart contracts on blockchain networks.

One of the keys behind a good tokenomics strategy is that a token should appreciate in value. In my article and paper about tokenomics auditing, I explained how blockchain projects should create a hierarchy of goals. Usually token appreciation ranks high up in the list of those goals.

A token that appreciates rewards early investors, makes the project richer, and ensures that long term viability of the whole endeavour.

While it’s not always possible to always guarantee price appreciation (since it can be influenced by external factors, such as the state of the market), it’s important to have a tokenomics framework that guarantees price appreciation under the right conditions.

The equation of exchange

As some of you might know, I was one of the first researchers in the area of tokenomics. Years ago, I published an article on how to value ICOs This article was based on the equation of exchange, which was proponed by Vitalik Buterin as a model to estimate the value of tokens. I then also published another article that evolved the original concept, on how to value Initial Coin Offerings.

The equation of exchange is famous tautology in monetary economics that connects the total value of an economy to the value of its coin.

Quoting Wikipedia:

where, for a given period,

is the total nominal amount of money supply in circulation on average in an economy.

is the velocity of money, that is the average frequency with which a unit of money is spent.

is the price level.

is an index of real expenditures (on newly produced goods and services).

Vitalik Buterin flipped velocity and the price giving us the following equation:

MC = TH

Where C is the price or the cost of a token, defined as C=1/P, and H is the average holding time, defined as H=1/V. This makes calculations conceptually easier for an ICO.

Regarding M, this is now the total number of coins, and T is the total economic value of transactions.

So, the value of a token becomes

C=TH/M

So, in simple terms what this means is the following:

- The greater the value of the economy (denominated in dollars), the greater the value of the token.

- The greater the holding time (that is users stake, etc., instead of just dumping the token), the greater the value

- The more tokens in circulation, for a given level of transactions, the smaller the value of the token

So, what can we do with that information?

Using the equation of exchange for token economics

The equation of exchange is simply telling us what the price of a token should be for a given level of transaction volume, number of tokens, and holding time. So, how can we use that?

An analogy I like to use a lot these days is to describe a token economy as similar to the economy of a real country. A token economy needs to have inflows of cash in order to survive. Those inflows of cash are defined by the term T in the equation of exchange, and are denominated in fiat currency (most commonly USD).

Cash inflows

It’s important to understand that no amount of tokenomics wizardry can help a project that doesn’t have cash inflows! This is by far the most important parameter.

The second parameter that’s very important to also understand is that users should have an incentive to hold the token, or exchange within the economy of the system. This goes back to the country example. A country that has many exports, receive cash for those exports, and then keeps the cash within its borders to re-invest it in value-adding activities, is usually a strong economy. The same thing is true for token economies.

What you want, is you want the users to invest their money in exchange for your token, and then do things with this token like:

- Stake it, and hence take it out of circulation, increasing holding time H and the value of the token.

- Exchange it for product or service, which will help them generate value in fiat, and in then will incentivise them to provide more fiat to the system, in exchange for tokens.

Distribution schedules

You also need to ensure that the economy is growing at a pace that it can sustain the token distribution schedule. If too many tokens are released, then, there can be an inflationary pressure on the token, which reduces the price (in dollar terms).

The graphs below show some simple examples of three possible scenarios

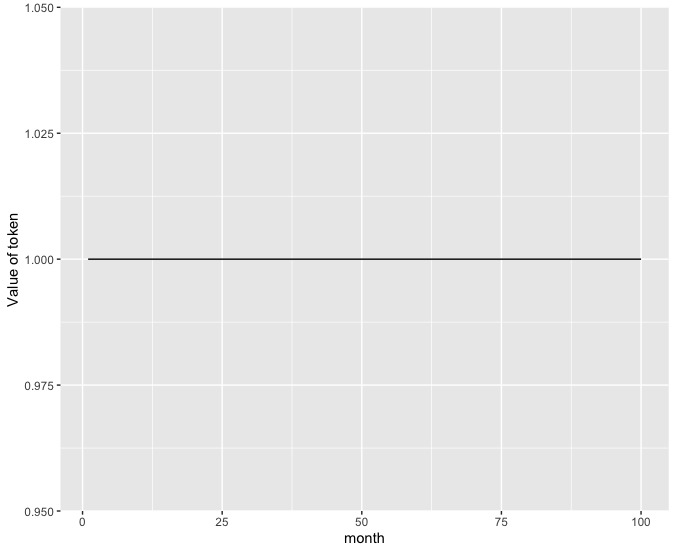

Scenario 1: Value grows at the same pace as the token release schedule

In this case, we observe roughly constant value (in dollar terms)

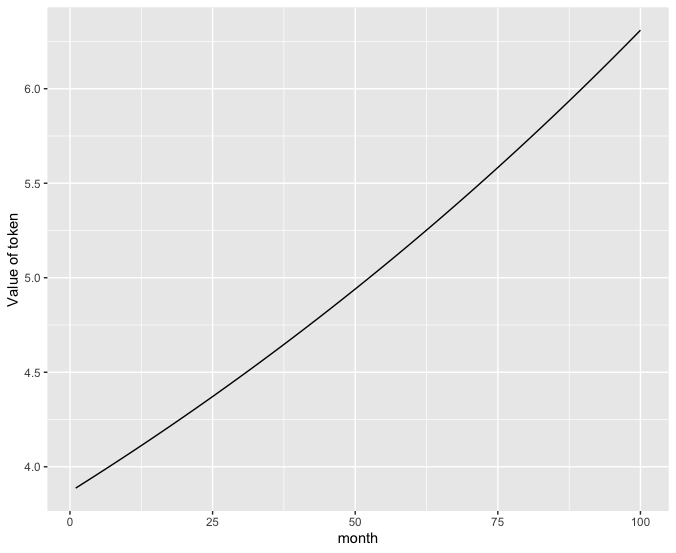

Scenario 2: Value of the economy (in dollar terms) rises faster than token distribution schedule

In this case, the token appreciates in value.

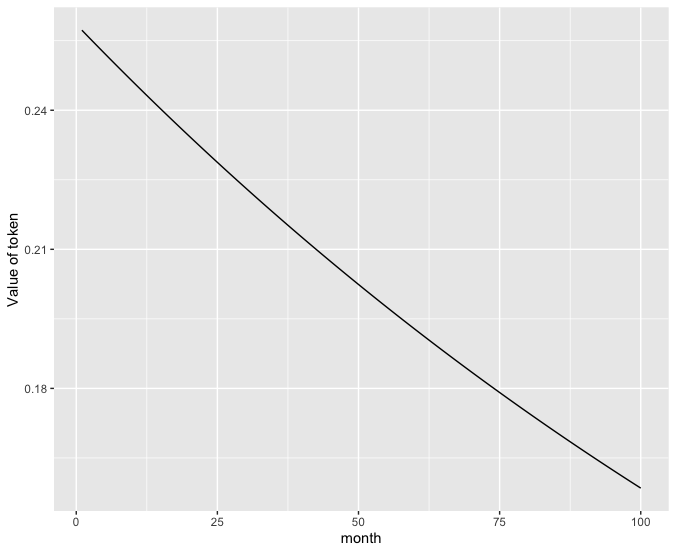

Scenario 3: Value of the economy grows at a slower pace, than the token release schedule

In this case, the value of the token approaches 0. This is called “hyper-inflation” in the real economy. For example, excessive money printing, diminishes the value of money. In a real economy, this manifests as products and services having higher prices, which means that the coin itself has become weaker, and hence has lots value. In a token economy, the effect is the token having very low value in dollar terms. A very good example of this phenomenon in a real economy is Argentina’s inflation problem.

Incentivising holding the token in a token economy

One of the most common mechanisms to preserve a token’s value is to incentivise holding. This is something that the blockchain community has realised is a very easy and useful way to preserve a token’s value. A problem with this mechanism is that it can work, even when the tokenomics are flawed.

This is a problem with OlympusDAO forks (and maybe some would argue, with OlympusDAO itself). They incentivise holding, pumping the price up. At the same time, they get inflows from more users, but unless they generate enough value from this money, the whole system is just a big Ponzi that is waiting to implode.

So, while increasing the holding time is a great way to preserve value, it’s primarily a hack, and it doesn’t make up for bad business models and practices. Token economics can only take you so far.

Blockchain, token economics, DeFi and AI

If you are interested in topics such as tokenomics, blockchain, DeFi, but also data science and AI, make sure to get in touch. I would be more than happy to speak with you. Also, please make sure to check out the page of the Tesseract Academy, my consultancy which deals with education and services in the both the areas of AI and blockchain. There is also a great framework for tokenomics which you can find on that page.

Also, make sure to check out this article on how to read ICO white papers. While ICOs have now evolved into IEOs (Initial Exchange Offerings), and IDOs (initial DEX offerings), the lessons in that article are still relevant.