Auditing tokenomics

I am very proud to announce that the tokenomics auditing framework is published by the Journal of the British Blockchain Association.

Tokenomics, the study of token economies, is a rapidly evolving field that originated around 2017 with the growth of Ethereum and the possibilities it offered for creating tokens. This led to the generation of artificial economies with novel incentive alignment. By 2018, the significance of tokenomics in the Web 3.0 space was widely recognized, driving innovations in blockchain like DeFi, whether through successful lending and borrowing protocols or failed experiments like Terra/Luna.

As blockchain adoption expands, the focus in tokenomics is transitioning from simple utility designs to complex, interconnected economies. One emerging trend is tokenomics auditing, a practice that examines and suggests improvements to token economy designs, which often become too complex to evaluate in practice.

The rise of tokenomics auditing represents a step towards standardization in the field. While still somewhat subjective, there is a growing push to develop an objective, expert-approved auditing framework. This would provide a structure for auditors to follow and assess token economies based on uniform criteria.

How can you audit tokenomics?

In the paper, we propose a framework based on a questionnaire that assesses a series of issues ranging from structural issues, all the way to stress tests. Some of these questions can be answered in a straightforward way, whereas others require the use of game theory or simulations.

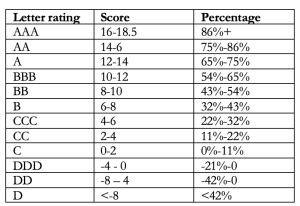

The questions add up to points, which can then be used to give a project a letter score. The scoring system can be seen in the table below.

Tokenomics auditing scoring system

The power behind such a framework is that it can give more awareness to investors around the risks of a particular project. For example, when we applied the framework to Terra/Luna, we found out that Terra/Luna would acquire a score of BB. This means that the protocol wasn’t bad, but it contained certain risks. This is definitely not what had been communicated to investors around during the existence of the project, and it led to financial ruin for many of its users.

The questions are presented in the next section. A more extensive discussion can be found in the paper.

If you want to go through some other tokenomics audits make sure to check the following links

If you are interested in this kind of work, make sure to check out our tokenomics services.

The tokenomics auditing framework questions

Business-Token interaction

- Do tokens improve the current business model? Yes:1, No:0

- Is the token nice to have, or an essential part of the business model? Essential: 1, Nice-to-have: 0

- Can the project gain value (not the token) in fiat terms? Yes:1, No: -1

Structural Analysis

Break down explaining main system mechanisms and interactions:

- Cash-flows:

- Does the token economy have an influx of value (e.g., in fiat) coming in? Yes: 0, No: -1

- Does money stay in the token economy, or is there pressure to immediately sell? Stay: 1, Sell-pressure: -1

- Are there ponzi-like elements? Yes: 0, No: 1

- Mechanisms and all economic agents involved

- Do interactions generate additional value expressed in fiat? Yes: 1, No: 0

- Does the project require a critical mass in order to be able to provide value? E.g., social networks are a good example of this. Yes: 0, No: 0.5

- Are the incentives speculative? For example, rewards with no underlying value? Yes: -1, No: 0

- Demand Drivers

- Do all the demand drivers depend on controllable factors or uncontrollable factors? An example of a controllable factor is product quality. An example of an uncontrollable factor can simply be the market conditions. Controllable: 1, Uncontrollable: 0

- Are there levers the economy can use to influence demand? Yes: 1, No: 0

- Do they depend on entities that generate real economic value or more on internal or speculative factors, e.g., expected token appreciation because of rewards? Real economic value: 1, Speculative: -1

- Governance:

- Can a majority take over? Yes: -1, No: 1

- Can governance cause sticky points? For e.g., votes need to take place, but no one is voting. Yes: 0, No: 1

- Empirical proof:

- Has there been proof that the mechanisms used in the project can work successfully? Yes: 2, No: 0

Allocation and Distribution

- Does the allocation favor pump-and-dumps? Yes: -1, No: 0

- Does it provide unnecessarily large stakes to certain actors? Yes: -1, No: 0

- Does the distribution avoid creating unnecessary sell pressure? An example of this can be excessive airdrops. Yes: 1, No: 0

Stability and stress tests

- How exposed to shocks is the token? Answering this requires simulations. Use a scale from -2 to 2. A 2 represents a token that can withstand huge shocks (e.g., massive bear market), and a -2 represents a token that can only appreciate when conditions are perfect.

- Does the token appreciate when simulated? If the objective of the token is to provide a peg or some other functionality, then this question can be ignored. Yes: 1, No: -2

- Does the system have feedback loops, which could accelerate a crash (e.g. the Terra/Luna case)? Yes: -1, No: 1

Points interpretation

The maximum score can be 18.5:

- Business-token interaction(3)

- Structural(10.5)

- Allocation and distribution(1)

- Stability and stress tests(4)

The lowest possible score can be -13:

- Business-token interaction(-1)

- Structural(-5)

- Allocation and distribution(-2)

- Stability and stress tests(-5)