Digital Banking, also known as online banking, is the digital transformation of traditional banking services via the Internet. Numerous digital banking services exist, such as mobile banking, P2P payments, electronic data interchange(EDI), and more.

Digital banking has only been possible through the digital transformation. So, what is digital transformation?

Digital transformation is the use of digital technologies to modify traditional or non-digital products and services, better catering to the needs of the evolving market and customers. In this article, let’s explore the future of banking with digital transformation and how it can impact our lives.

Understanding Digital Transformation in Banking

The banking sector has constantly evolved, from barter systems to AI investment banking, from the Roman Empire to every individual’s phone. People’s rising needs and wants correspond precisely with the ever-evolving banking sector.

Limited ease of access, scalability, and other outdated features, like heavy time consumption and high operational costs, have demanded traditional banking to transform into digital banking.

The easy accessibility and availability of banking services on our devices result from utilizing digital transformation components. Some helpful vital components are as follows:

- Omnichannel banking with multiple online banking platforms

- Cloud computing and cyber security

- Personalization with AI and machine learning

- Automation and optimization with RPA

- Open banking

Digital transformation helps financial services providers increase profitability, stimulate growth and improve customer convenience, attracting new customers.

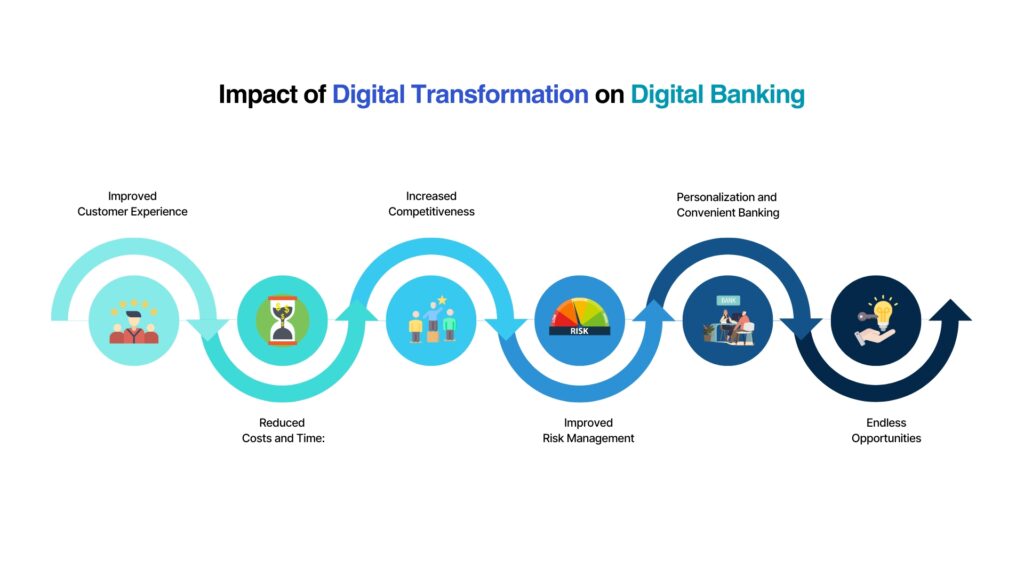

Impact of Digital Transformation on Digital Banking

Digital transformation has impacted banking in numerous ways. Some of these impactful points are as follows:

Improved Customer Experience:

Digital transformation has improved customer experience by providing efficiency and effectiveness in operations. An enhanced experience increases customer satisfaction, hence increasing users and clients.

Reduced Costs and Time:

Due to advanced technologies, the cost and timing of banking operations have been streamlined. Tasks that once cost heavy amounts and involved hectic transportation up-downs are now easily and freely available on our devices.

Increased Competitiveness:

The need for rapid innovation for a larger market share and unique selling proposition (USP) has made financial institutions fiercely compete with each other and get ahead of their competitors, securing a wider market position. Thus providing fresh and varied innovative solutions to customer problems.

Improved Risk Management:

AI and blockchain technology have improved risk mitigation in the banking industry. Automation and decentralization of data help in understanding and securing the data by more personally understanding consumer behavior.

Personalization and Convenient Banking:

The personalization and smooth latest processes in the banking sector have increased user convenience. With technologies like AI and chatbots, personalization caters to customers’ unique needs and wants, making users feel more entitled. The availability of financial services with automation has increased customer retention and reliability.

Endless Opportunities:

With the Internet of Things(IoT), application programming interfaces (APIs), and cloud computing, banks and financial institutions have increasingly adapted to increasing clients’ and customers’ needs. Hence, digital transformation offers endless opportunities for innovation and more solutions.

Types of Digital Banking

Digital banking offers numerous benefits, such as being fast, more secure and less expensive. There are several types of digital banking, but some of them that are innovative and acquire a huge market share are as follows:

- Online and Mobile banking:

The term used when banks offer online services such as transferring funds, accessing bills, and managing accounts via the Internet is known as online banking, and these banking services performed through mobile devices are known as mobile banking.

- Neobanks:

These types of banks only have online platforms and not physical branches. Monzo and Jupiter are some of the examples of Neobanks.

- Payment Banks:

Payment Banks provide basic banking services but operate on a small scale and do not offer any credit facility—few, e.g. Airtel payment banks, Paytm payments banks, etc.

- Crypto Banks:

These banks don’t operate on money but on cryptocurrency for deposits, transfers and lending purposes. For e.g. Binance and Coinbase, etc.

- Open Banking Platforms:

Platforms that use APIs to build applications and services around a financial institution by third-party developers are known as open banking platforms and are going to revolutionize the banking sector.

Future trends in the Banking area

Banks can implement more innovative solutions and strategies with custom software development services. This will power the future of banking and will provide more future opportunities like these few future trends in the banking sector:

Artificial Intelligence and Machine Learning:

Artificial intelligence and machine learning increase banking security by detecting fraud, tracking down bad systems, and reducing risks. With time, banks have incorporated AI-based systems in loan and credit decisions to make more informed and safer conclusions.

Cybersecurity:

The latest technologies will benefit everyone, including bankers, recruiters, analysts, and hackers. Yes, advanced technologies can create new opportunities for cybercriminals to breach customer data and launch social engineering attacks on banks. So, to prevent fraud, AI and machine learning will be used to improve cybersecurity measures.

Blockchain and Cryptocurrency:

Blockchain technology has been a revolutionary element in the tech world. It has simplified the KYC process and securely verified customer identities. Crypto is based on blockchain, which helps build a more transparent and open financial system. Crypto can be used as a medium of exchange. Also, banks can provide various services like custodial accounts, which allow customers to store their digital assets.

Open Banking:

Platforms that use APIs to build applications and services around a financial institution by third-party developers are known as open banking platforms and are going to revolutionize the banking sector.

Key Benefits and Challenges of Digital Banking

Digital banks can reach a market volume of US$2.74tn by 2028. Though digital banking is a double-edged sword, with advantages outnumbering challenges, let us look at its key benefits and challenges.

Benefits:

- Ease of access and convenience: Online banking is all about convenience as it facilitates no transportation chaos, no being in long lines for banking tasks, cardless ATM withdrawals, and many more.

- Efficient costs: With lower transaction costs, minimizing operational inefficiencies, and no regular visits to branches save a lot of money for banks and customers.

- Advanced features and opportunities: The latest technologies have transformed banking with many advanced features, such as UPI, automated payment facilities, and digital account opening, giving room to fresh and varied opportunities.

- Enhanced security and control: Multi-factor authentication, such as biometric authentication, OTP, and facial recognition, leads to a more secure and controlled environment for the operation of financial services.

- 24×7 Availability: You can access banking services whenever you want from anywhere in the world with just a click. This 24×7 feature helps you not delay your tasks but prioritize them.

Challenges:

- Security threats: Security is the protection from potential threats. Hackers and criminals can illegally misuse banks’ customer databases by breaching security with the latest technological advancements. As it is online, a single breach can result in the data loss of millions of customers.

- Need for expertise: Digital transformation is a complex and ever-changing process requiring top technical expertise and specialists. With the ongoing speed of technological progress in the banking sector, the need for experts will increase in the near future.

- Technical issues: No matter how advanced technology becomes, banking institutions are still vulnerable to intentional or unintentional operational downtimes. Integration challenges, compatibility issues, and legacy system migration are a few examples of technical concerns.

Why Does the Banking System Need a Revolution?

Why did the banks shift from simple barter systems to complex multi-level cloud server banks? Why did the banks’ services expand with the rising needs of consumers? And why did they go from coins to cryptocurrency, from heavy interest to no-cost EMI? The answer is straightforward: ‘to be in the market’. Because if you don’t follow the existing trends, you will be long forgotten.

The banking system has evolved from standard money lending practices to international merchant banks offering numerous services. When the Internet came, the world knew it would soon be involved in the financial sector, which eventually happened. As time passed, many banks, such as Goldman Sachs, JP Morgan, etc., adopted mainstream Internet practices to sustain themselves in the market.

The banking system will constantly evolve. No matter how high-tech the technologies are, there will always be some scope for improvement. That is the sole reason why it needs a revolution and will constantly be needed to satisfy customer needs and wants.

Conclusion

In conclusion, we stand on the verge of a new era in which the banking sector is powered by dynamically shifting digital transformation, with web 3.0 technologies such as blockchain, crypto, semantic web, and many more.

By understanding the probable challenges and future trends in the market, we can forecast the possible solutions and trends. Offering us more secure, accessible, and quick financial services through new innovations.

Author Bio:

Anirudh Saini is the Content Writer of BuzzClan. He is a passionate part-time Content Writer and a full-time Learner who uses words to convey his knowledge. He specializes in writing on technical concepts like AI, Cybersecurity, Cloud Computing, SEO, and more related to the digital economy and finance.

He is a curious learner who enjoys experimenting with fresh and varied areas like philosophy, psychology, and technology. Writing blogs and articles on Medium, LinkedIn, and Noupe, with a keen interest in poems and quotes he aims for excellence and endeavors personal and career growth.