You probably know what sentiment analysis is and how it works, especially if you’re a pro investigator or trader. But if you’re new to the world of sentiment analysis or need a refresher, this comprehensive article is ideal for you.

Sentiment analysis is a fundamental concept for deeply understanding the behaviour of crypto markets. It can provide valuable data on future trends in the cryptocurrency market. This concept evaluates the feelings, attitudes, emotions, and moods surrounding a digital asset. It helps determine other traders’ feelings about a specific or general crypto market.

Crypto sentiment analysis is vital as it can massively impact the value of any digital asset. The cryptocurrency market reflects a lot of data and speculation. Different traders have their own opinions on why the crypto market behaves the way it does and whether to invest at that particular time.

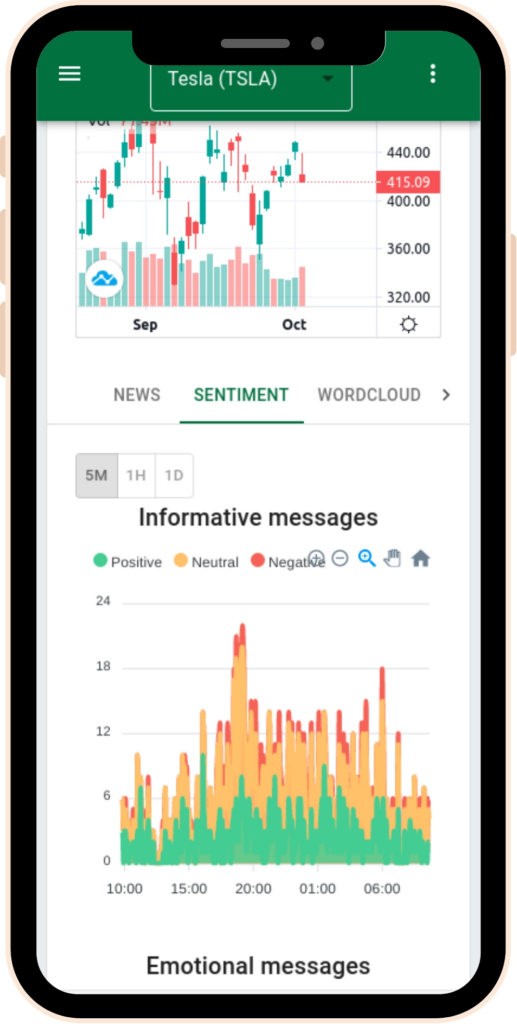

Crypto sentiment analysis platform StockGeist and other tools become useful as they help weigh most of the opinions that drive the cryptocurrency market. Sentiment analysis allows you to discover the opinions of the experts and pro traders controlling the crypto market and weigh in on their respective market positions.

Is Market Sentiment Analysis Helpful?

Most trading strategies massively rely on market sentiment analysis. But it’s an excellent idea to make decisions depending on a blend of all available information, similar to fundamental or technical analysis. When you perfectly blend fundamental and technical analysis with market sentiment analysis, you can easily:

- Boost your understanding of medium and short-term value action

- Enhance your control over your feelings

- Discover potentially profitable opportunities

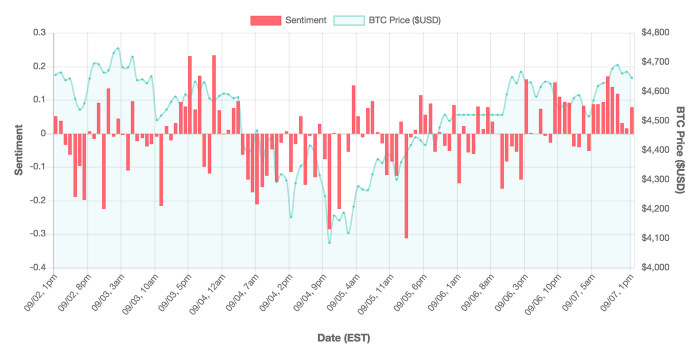

Sentiment in reviews, social media posts, blog posts and feedback correlates with market value movements. That means sentiment analysis can be a perfect way to find where and when to invest in crypto.

How to Perform Crypto Sentiment Analysis

A successful crypto sentiment analysis process starts with gathering opinions, ideas, and market views. Combine the information you collect with your existing experience and knowledge to get actionable conclusions.

Access relevant social media channels and pages to see how investors and the community feel about the digital asset’s value. Join official forums, telegram groups, and Discord servers to communicate directly with the community members and projects’ teams.

However, you should always exercise caution and abstain from basing your decision on a single metric. The use of social media channels and pages is only the first step. Numerous techniques for getting a broad image of market sentiment exist. In addition to social media, especially Twitter, you should:

- Gather information related to digital assets like investors’ tweets mentioning crypto, texts including public sentiment, and reviews.

- Collect historical value changes of different digital assets

- Clean your dataset to eliminate unrelated items

- Label your content in the dataset depending on emotional tone as either positive, neutral or negative using an automated tool.

- Train your model using a labelled or known dataset

- Evaluate your model’s performance

A perfect example of a crypto sentiment analysis can be seen here. If you want to simplify the entire process, you can work closely with a leading crypto sentiment analysis platform.

Streamlining Crypto Sentiment Analysis with Advanced Tools

As the importance of sentiment analysis in crypto trading continues to grow, so does the evolution of tools and platforms designed to facilitate this process. Advanced sentiment analysis platforms, such as StockGeist, leverage machine learning algorithms to sift through vast amounts of data from various sources. These tools not only analyze textual content but also take into account the context and tone, providing a more nuanced understanding of market sentiments.

The integration of artificial intelligence in sentiment analysis not only enhances the accuracy of predictions but also enables real-time monitoring of sentiment shifts. This evolution empowers traders with timely insights, allowing them to adapt their strategies swiftly in response to changing market sentiments. As the crypto landscape evolves, so too will the sophistication of sentiment analysis tools, further solidifying their role as indispensable assets for traders navigating the dynamic cryptocurrency markets.

Supercharge Your Crypto Journey with Tokenomics Consulting Expertise!

As you venture through the dynamic realm of cryptocurrency, mastering the intricacies of crypto sentiment analysis becomes crucial for well-informed decision-making. While tools like StockGeist can keep you ahead of market sentiments, there’s a level of expertise and tailored strategy that only Tokenomics Consulting Services can offer.

At Tokenomics Consulting Services, we’re committed to providing crypto enthusiasts and investors with unparalleled insights and strategic solutions. Our seasoned team of analysts and consultants specializes in navigating the complexities of crypto sentiment analysis, risk management, and market trends. Elevate your crypto journey to new heights by joining forces with Tokenomics Consulting Services.

- What is the F-1 measure and why is it useful for imbalanced class problems?

- From Data Streams to Decentralized Worlds: Exploring the Role of Blockchain Subgraphs in Gaming Infrastructure

- How to predict customer churn using machine learning, data science and survival analysis

- Business models in data science and AI