Recently I had the opportunity to finish the audit for an interesting project in the area of Fantasy Football and Web3.0 called KiX.

KIX is a next-generation, web3 fantasy sports decentralized exchange (DeX).

On the KIX DeX traders can buy and sell sports star tokens that are valued via customer demand and earn winnings derived from real-life player performance statistics – all with the speed, transparency and community governance enabled by the blockchain.

Something which makes KiX stand out is the heavy use of bonding curves in the design. So, let’s delve a bit deeper into it.

What is a bonding curve?

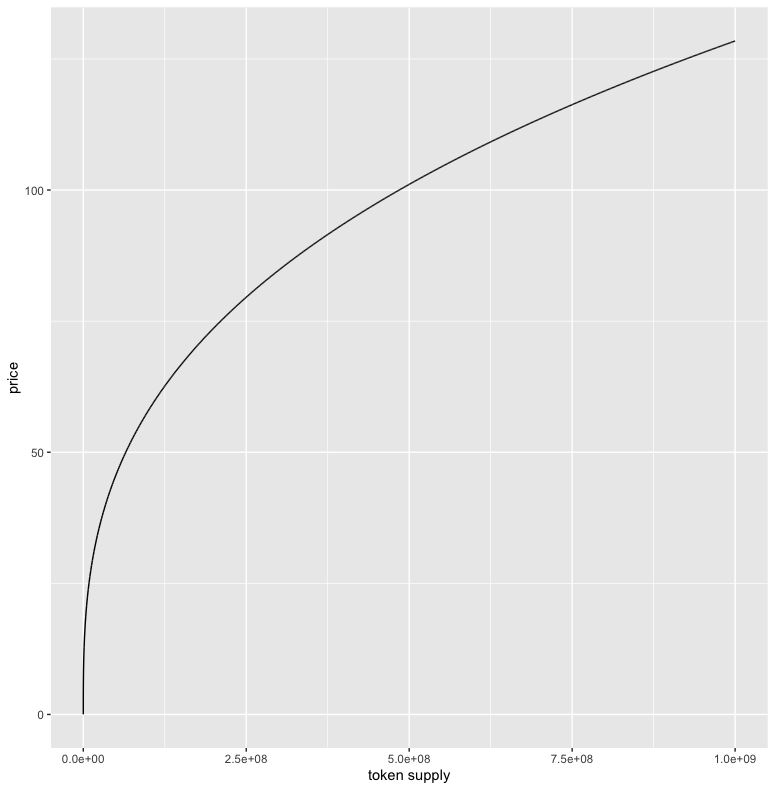

Bonding curves define a relationship between the price and the supply of a particular token. Here’s a detailed explanation:

A bonding curve is essentially a mathematical curve that determines the price of a token based on its supply. When a token is bought, it’s minted and added to the total supply, moving up along the curve and increasing the price for the next buyer. When a token is sold, it’s burnt or destroyed, reducing the total supply, moving down along the curve and decreasing the price for the next seller.

Bonding curves serve as an automated market maker mechanism, allowing tokens to be bought or sold at any time without requiring a counterparty. The price is not determined by market orders, as in traditional exchange order books, but by the predetermined bonding curve.

This concept can be useful for several reasons:

Liquidity: Bonding curves ensure constant liquidity. Because the contract itself acts as a market maker, buyers and sellers do not have to wait for a counterparty to trade.

Price Predictability: The shape of the bonding curve is known ahead of time and is immutable. This adds a layer of price predictability as participants can foresee how supply changes will affect the price.

Fair Distribution: Initial token distribution via a bonding curve can be seen as a fair launch method, as the price starts at the lowest possible point.

Fundraising: For projects, the area under the curve represents the pool of funds held by the smart contract. As more tokens are bought, more funds are locked in the contract, which can be used for project development.

Token Value: Bonding curves can create intrinsic value for a token. Tokens are always redeemable at the current price point on the curve, providing a built-in price floor.

Which projects are using bonding curves?

Here are some Web3.0 projects using bonding curves and why they are using them:

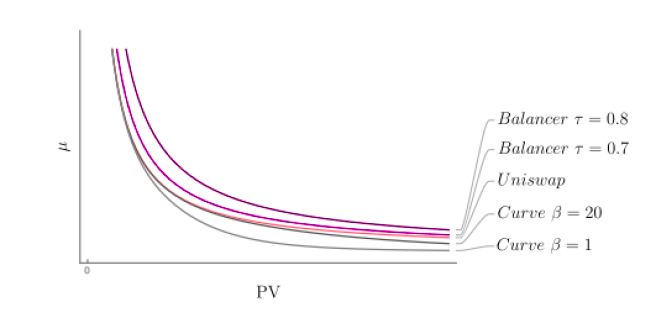

Uniswap is a decentralized exchange that uses a constant product bonding curve to provide a decentralized way to exchange tokens. The curve ensures that the price of each token in the pool remains relatively stable, even as the number of tokens in the pool changes.

Curve Finance is another decentralized exchange that uses a constant product bonding curve. Curve Finance specializes in trading stablecoins, which are cryptocurrencies that are designed to maintain a stable value. The bonding curve ensures that the prices of stablecoins on Curve Finance remain very close to their pegs, even as the supply and demand for each stablecoin changes.

Aave is a lending platform that uses a constant product bonding curve to provide a lending platform with low interest rates. The bonding curve ensures that the supply of Aave’s lending tokens (aTokens) remains relatively stable, even as the amount of money that is lent out changes. This helps to keep interest rates low for borrowers.

SushiSwap is a decentralized exchange that uses a constant product bonding curve. SushiSwap is similar to Uniswap, but it offers lower fees and a more user-friendly interface.

Balancer is a decentralized exchange that uses a constant elasticity bonding curve. Balancer’s curve is more flexible than the constant product bonding curve, which allows it to support a wider range of assets.

Why is KiX using bonding curves?

KiX is focused on five features to set it apart from the competition:

- Fully decentralized exchange – No need for KYC, your keys your crypto through a self custody wallet.

- Twice weekly winnings – Each game week will be divided into two Game Groups. Each grouping has a separate payout and allows traders to maximize winnings yield.

- Assured liquidity – Footballer tokens are fungible and paired with a platform token to help ensure that traders can buy and sell 24/7 in a continuous market.

- On-chain data – Our partner and data provider for sports data ensures that even the sports data feed is fully Web3.

- DAO – The project is a non-profit foundation with a DAO at it’s core, all holders of the platform token will have the opportunity to help govern the project too.

Bonding curves facilitate with point 3 (assured liquidity). The users can be assured that the project will always have liquidity, no matter what.

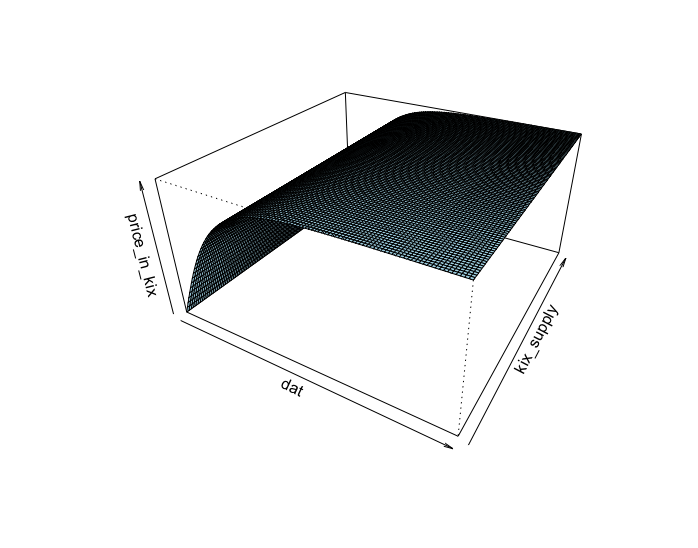

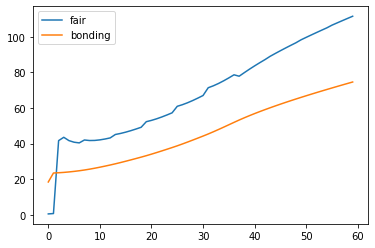

Obviously, the fact that there is liquidity is different problem to whether the value of the token is preserved. This is why we had to resort to simulations

Tokenomics design and auditing

If you are interested in learning more about our tokenomics services make sure to get in touch! We’ve helped many Web3.0 startups fix and improve their tokenomics. We would be more than happy to do that for you.

You can read more about how we can help you, as well as some testimonials, here.