Bitcoin, the pioneering cryptocurrency, has captivated the financial world since its inception in 2009. With its price subject to dramatic fluctuations, understanding the forces that drive its valuation is crucial for investors, analysts, and enthusiasts alike.

This article explores the multifaceted factors influencing Bitcoin’s price, from market demand and supply dynamics to regulatory influences and technological advancements.

Factors Affecting the Price of Bitcoin

Below are some of the factors that help determine Bitcoin’s price.

Supply and Demand

One of the largest determinants is the basic economic principles of supply and demand. Bitcoin’s supply is limited to 21 million coins, a cap set by its creator, Satoshi Nakamoto. This scarcity mimics the supply constraints of natural resources, contributing to its comparison to ‘digital gold.’

As demand fluctuates, so does bitcoin’s price. Demand can be influenced by factors such as investor interest, adoption by merchants and consumers, and the overall public perception of its value as an asset.

The Halving Events

A unique feature of Bitcoin blockchain is the halving event, which occurs approximately every four years. During a halving, the reward for mining new blocks is cut in half, effectively slowing down the rate at which new bitcoins are created. These events can lead to speculative anticipation and increased buying activity, potentially impacting Bitcoin’s price.

Market Sentiment and Investor Behavior

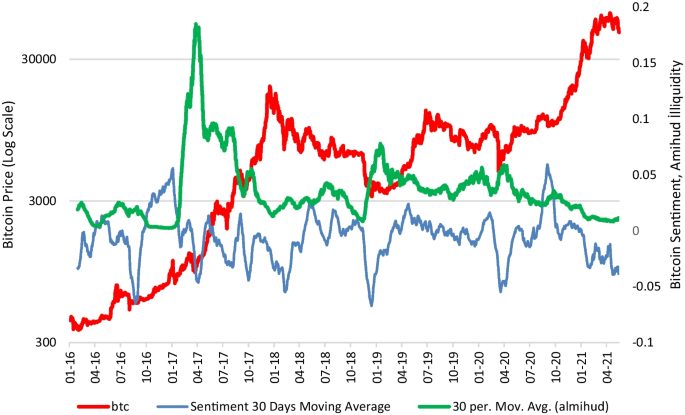

Investor sentiment plays a pivotal role in Bitcoin’s valuation. News events, social media trends, and investor attitudes can lead to rapid changes in demand.

Positive news, such as a major corporation’s adoption of Bitcoin or favorable regulatory updates, can spur demand, while negative news can lead to declines.

The Role of Media

The media’s influence on Bitcoin’s price cannot be overstated. Sensational headlines can drive speculative bubbles or trigger sell-offs. The cyclical nature of media coverage means that Bitcoin investors must navigate a landscape where perceptions can be as influential as reality.

Regulatory Environment

Regulatory announcements and decisions in major economies have immediate effects on Bitcoin’s price. For instance, announcements of stricter regulations or bans in countries with significant cryptocurrency activity can lead to price drops, while regulatory clarity or favorable legislation can encourage investment and drive prices up.

Technological Developments and Innovations

Bitcoin’s underlying technology, blockchain, is continuously evolving. Developments that enhance its efficiency, security, or usability can positively affect investor confidence and demand.

Conversely, security breaches or successful hacking attempts can undermine confidence and negatively impact prices.

Bitcoin and AI

The intersection of Bitcoin and AI represents a fascinating frontier in the digital age. AI’s capabilities in analyzing market trends, predicting price movements, and executing trades can significantly influence Bitcoin’s liquidity and volatility.

As AI technologies become more sophisticated, their impact on Bitcoin’s ecosystem and price dynamics is expected to grow, offering both opportunities and challenges for investors.

Economic and Global Events

Global economic conditions and geopolitical events can influence Bitcoin’s price. In times of economic uncertainty or inflationary pressures, investors may turn to Bitcoin as a hedge against traditional financial systems, driving up its price.

Conversely, economic stability and positive growth can reduce Bitcoin’s appeal as an alternative investment, potentially leading to price declines.

Conclusion

Understanding what determines Bitcoin’s price requires a holistic view of a complex ecosystem. The interplay of supply and demand, market sentiment, regulatory landscapes, technological advancements, and global economic conditions all contribute to the cryptocurrency’s valuation.

As the digital currency landscape evolves, so too will the factors influencing Bitcoin’s price, making predicting its future as challenging as it is fascinating. For investors and enthusiasts, staying informed and adaptable is key to navigating the volatile waters of Bitcoin’s market.

Ready to take your cryptocurrency trading to the next level?

Our tokenomics consulting services provide expert guidance to help you navigate the challenges of the crypto market and maximize your profits. From mastering risk management techniques to leveraging advanced tools like sentiment analysis, our team is here to support you every step of the way. Don’t let market tendencies dictate your success—partner with us and gain the knowledge and strategies you need to thrive in the world of crypto trading.

Contact us today to learn more and elevate your trading game!