What are Non-Fungible Tokens?

A non-fungible token (NFT) is a type of digital token that is unique or limited in some way. This means that two non-fungible tokens are not interchangeable. Some well know examples of a non-fungible tokens are cryptokitties, bored ape yacht club, and many of the art collectibles someone can find on OpenSea.

NFTs are a hot topic in the blockchain space, with applications in various industries from art to gaming, and the metaverse.

NFTs have become a huge market with market capitalization reaching $40billion in January 2022. Therefore, many investors have started treating them as a new kind of asses class.

A question that investors need to ask is how can you value NFTs? NFTs are a special asset class for many reasons. Also, NFTs do not all have uniform characteristics. The way that NFTs are used in a game, might be very different from the way they are used in art.

For example, Axie Infinity is the first blockchain game to combine collectible trading card gameplay with the capability to build a unique pet space. Players can own, battle, and collect a variety of digital creatures called “Axies.” Therefore, the value of the NFTs in Axie Infinity relates to the popularity of the game, but also to the value of Axies.

This is different from pieces of art displayed on SuperRare. Given that this space is so new, any method or technique used that can offer some advice in this area is incredibly useful. That’s why we used data science and statistical modelling in order to create a valuation model for cryptopunks.

Data science for valuing CryptoPunk NFTs

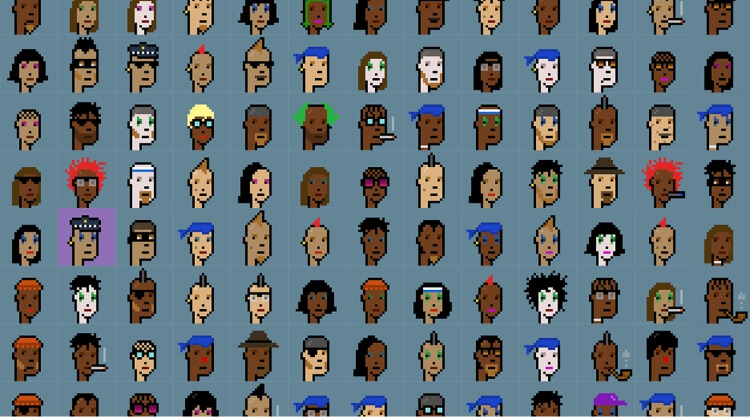

CryptoPunks is one of the most popular NFT collections. Cryptopunks consist of pixelated faces of characters with random attributes. Some of these are shown below.

At the time of writing, the most expensive CryptoPunk NFT was sold for $23million.

On a recent paper I worked on with one of my students, we used hedonic regression in order to study how the different attributes contribute to a CryptoPunk’s valuation. This is a data-driven methodology that can easily be applied in other types of NFTs. The paper also compares the performance of CryptoPunks against more traditional investment assets.

There are obviously many questions about how well the results of the study can generalise to other projects or in the future, given how volatile the NFT market is. Nevertheless, the methodology is simple enough to be used in any project. I expect that results will become more accurate as the market grows and more data is generated.

The full paper can be found here: Non-Fungible Tokens as an Alternative Investment: Evidence from CryptoPunks

Blockchain, token economics, DeFi and AI

If you are interested in topics such as tokenomics, blockchain, DeFi, but also data science and AI, make sure to get in touch. I would be more than happy to speak with you. Also, please make sure to check out the page of the Tesseract Academy, my consultancy which deals with education and services in the both the areas of AI and blockchain. There is also a great framework for tokenomics which you can find on that page.

Also, make sure to join our meetup on AI creativity, NFTs, and blockchain!