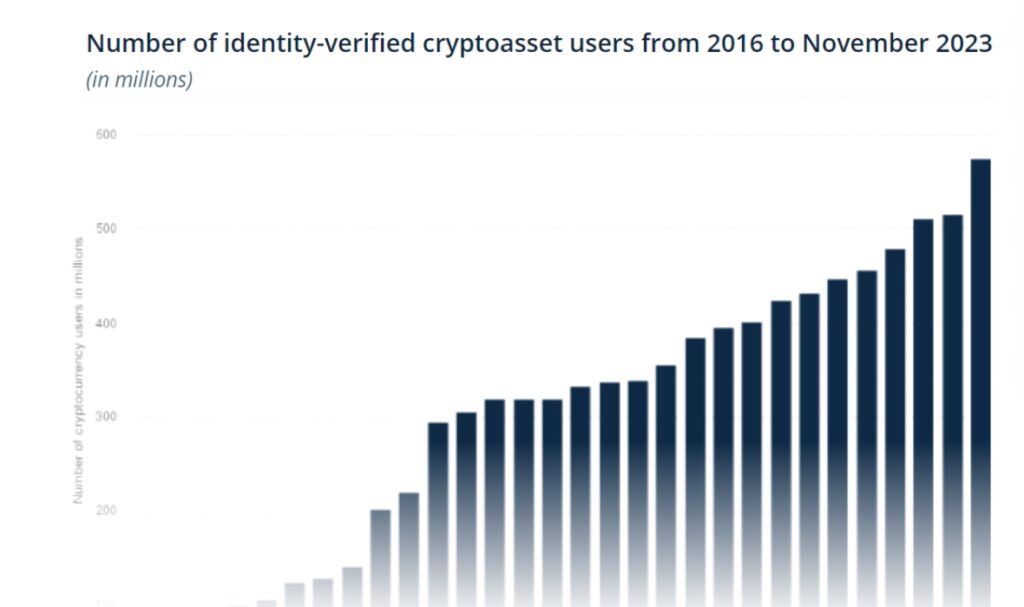

Cryptocurrency has quickly become one of the most exciting kinds of investment. With cost-effective fees and inflation protection, more and more investors are getting involved.

Experts estimate that up to 600 million crypto investors are operating today. But with these new freedoms and opportunities come challenges.

A lack of regulation means that the cryptocurrency industry is prone to manipulation. And governments are playing catch up—they aren’t moving fast enough.

This article will highlight a new threat in the market: cryptocurrency spoofing. You’ll discover how criminals trick victims into making poor investments. You’ll also learn ways to protect yourself and make safer investments.

What is cryptocurrency spoofing?

Spoofing can manifest in different ways, including email spoofing, URL spoofing, and many others. When it comes to cryptocurrency, spoofing refers to the act of manipulating the market. Scammers use bots and algorithms to place fake buy and sell orders on investments. This creates a fake sense of demand.

Innocent investors see this surge of interest and fall into a trap. They will invest in the fluctuating currency to capitalise on the “golden opportunity.”

Unfortunately, scammers cancel their orders at the last moment. It means they never follow through with their supposed plans. In this way, scammers can make bad crypto investments appear worthwhile and lucrative.

Spoofing can have an enormous impact on already volatile crypto markets. Scammers can flood the market with sell orders. This can manipulate investors into thinking a particular currency is toxic and prompt them to get rid of it.

Over time, scammers can assume total control over a currency’s value. It’s little wonder that crypto spoofing has become illegal in many countries. In the US, for example, the Commodity Futures Trading Commission oversees the industry. In the UK, the Financial Conduct Authority can fine traders who spoof investors.

That said, the practice still poses an ongoing threat to investors. It causes widespread paranoia as people grow weary of price fluctuations.

Five ways to protect yourself from cryptocurrency spoofing

Although the crypto markets can be unpredictable, there are ways to avoid spoofing scams and make safer investments. Below are several simple but effective ways to protect yourself:

1. Pay attention to industry news and trends

Like any investment industry, crypto values often follow industry news and trends. If something happens in the media, this can trigger a genuine response from investors.

One surefire way of spotting a spoofing scam is through simple research. Novice investors might not pay close attention to why something happens and invest on a whim. If there are sudden, sharp price changes in the crypto market, you must find out why.

If there’s little information available, it’s best to hold off until more information comes to light. Biding your time and knowing all the facts is better before parting with your money.

2. Be critical of social media and finfluencers

Every day, new crypto gurus emerge online to “guide” newcomers to the industry. They make bold claims about cryptocurrency, about what to invest in and what to disregard. Many of these accounts are, in fact, bogus. Accounts can manipulate metrics to appear more successful than they are.

Spoofers may use these social media accounts to spread fake crypto news. They may also try to instil FOMO (fear of missing out) on new investments.

If following financial influencers (finfluencers), you must be vigilant over their advice. Scrutinise their social media presence and pay close attention to such aspects as:

- Track record: Review whether they’ve been active in crypto for a long time or only recently entered it.

- Audience: Check the quality of audience engagement. Copy-and-paste posts may suggest they have a bot following.

- Proven success: Check whether any previous advice has proven true. Verify claims with outside professional sources, not testimonials from fans.

- Authenticity: Some spoofers may impersonate genuine financial services or businessmen to deceive fans. Double-check that accounts are authentic and verified.

3. Protect your crypto wallet with cybersecurity tools

Scammers may also track your online activity to create personalised spoofing schemes. As such, you must protect yourself when connected to the internet.

A Virtual Private Network (VPN) is a security tool that encrypts your internet traffic. This prevents scammers from being able to watch your online activity. So when you’re researching crypto investments or accessing your wallet, you’re protected.

Even on a public Wi-Fi network, a VPN can help ensure anonymity by masking your IP address. Premium VPNs also have built-in security features that protect you from malware and scan URLs. For example, URL scanners keep tabs on fake websites and help you prevent landing on them. This protects you from fake news and financial phishing schemes.

4. Remember common sense and think before you act

Crypto spoofing scams use time to pressure you into action. Or they might promise you an incredible return quite soon. They’ll claim that the fluctuating values are your “golden opportunity” to act before you miss out.

But scammers want you to act instinctively without thinking for too long. The hard reality is that if something seems too good to be true, it probably is.

The crypto industry is still in its infancy and lacks proper regulation. While governments try to stabilise markets, investors must remain vigilant.

Before investing, try to:

- Examine the white paper: Cryptos often have documentation explaining how it works. This should include its roadmap for the future, giving you a greater sense of its potential.

- Perform research: Check the credentials of the people behind the currency. Are they qualified enough for their ambitions?

- Get community support: Online communities are an excellent place to ask other investors for advice. They will usually scrutinise new currencies.

- Dive into tokenomics: Learn about the currency’s distribution, circulation, and supply. This can help you gauge a reasonable price for the crypto.

Some final tips

As with any investment, cryptocurrency will always have an element of risk. Yet the number of criminals targeting interested investors is rising. And you need to be ready.

This article has shown that avoiding cryptocurrency scams like spoofing can be straightforward. Stay educated, stay sceptical, and equip yourself with the tools and knowledge necessary to make informed decisions. Only then can you invest in cryptocurrencies with total peace of mind.

- Unlock the Power of AI: Unveiling Innovative Ways to Earn Income Online

- How Database Monitoring Services Can Ensure Business Continuity

- Artificial Intelligence in SEO: Exploring Opportunities for Semantic SEO, Data-Driven Strategies, Link Building, and More

- New book is out! Business models in emerging technologies