In the ever-expanding digital universe, the rise of cryptocurrencies has catalyzed the emergence of white label crypto exchanges, offering customizable solutions for trading various digital assets. As these platforms handle vast volumes of transactional data, the need for effective big data analytics becomes imperative. In this article, we delve into the realm of data visualization within big data analytics, focusing on strategies and technologies employed in handling and analyzing large datasets, with a spotlight on white label crypto exchanges.

Understanding Big Data Analytics

Big data analytics involves the process of examining large and complex datasets to uncover patterns, trends, and insights that can inform decision-making and drive business strategies. In the context of white label crypto exchanges, which facilitate the trading of cryptocurrencies and digital assets, big data analytics plays a crucial role in:

Transaction Processing:

Handling the massive influx of buy, sell, and trade orders across multiple digital assets and trading pairs.

Market Analysis:

Monitoring market trends, volatility, and liquidity to provide users with actionable insights for informed trading decisions.

Risk Management:

Identifying and mitigating potential risks, such as market manipulation, fraud, and cybersecurity threats, to safeguard users’ assets and maintain trust and integrity within the platform.

Strategies for Handling Large Volumes of Data

White label crypto exchanges encounter enormous volumes of transactional data, often exceeding petabytes in size. To effectively manage and analyze such data, several strategies are employed:

Distributed Computing:

Leveraging distributed computing frameworks such as Hadoop and Spark to distribute data processing tasks across multiple nodes in a cluster, enabling parallel processing and scalability.

Data Partitioning:

Partitioning large datasets into smaller, manageable chunks based on predefined criteria, such as time intervals or asset types, to facilitate efficient data processing and analysis.

In-Memory Processing:

Utilizing in-memory processing technologies like Apache Ignite or Redis to store and manipulate data in memory, reducing latency and accelerating data retrieval and analysis.

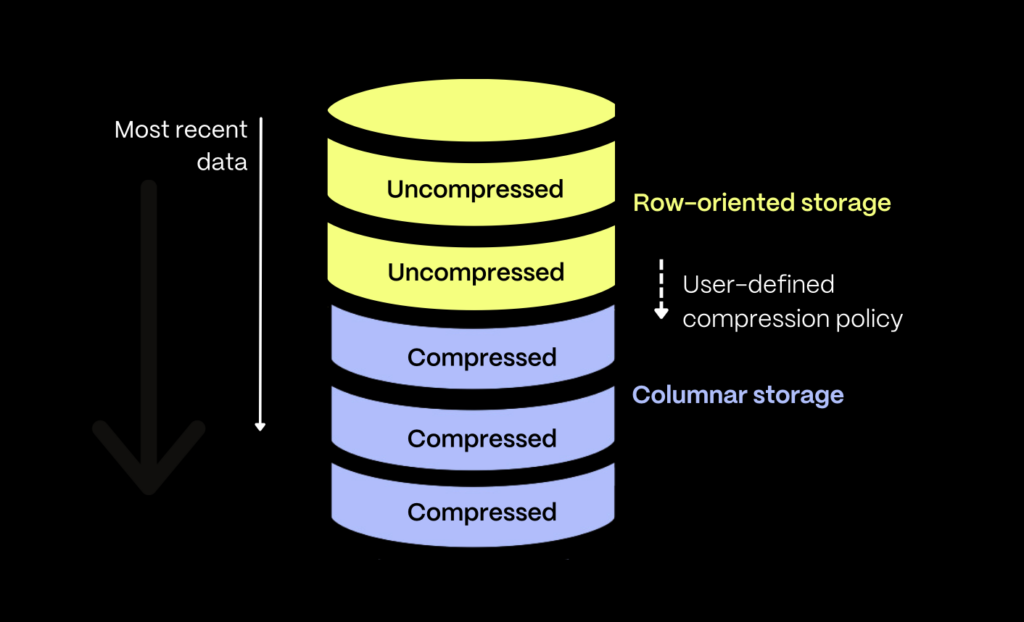

Data Compression and Storage Optimization:

Employing compression techniques and optimized storage solutions to minimize storage space requirements and enhance data retrieval performance.

Technologies for Big Data Analytics

In the realm of big data analytics for white label crypto exchange, several technologies and tools play a pivotal role:

Apache Hadoop:

An open-source distributed computing framework that facilitates the storage and processing of large datasets across clusters of commodity hardware.

Apache Spark:

A fast and general-purpose cluster computing system that provides in-memory data processing capabilities, suitable for iterative algorithms and interactive data analysis.

Apache Kafka:

A distributed streaming platform that enables real-time data processing and event-driven architectures, crucial for handling high-throughput data streams in cryptocurrency trading platforms.

Elasticsearch:

A distributed search and analytics engine that facilitates real-time search, analysis, and visualization of large volumes of data, enabling users to gain actionable insights from transactional data.

Data Visualization in Big Data Analytics

Data visualization serves as a powerful tool for distilling insights from large datasets and presenting them in a visually comprehensible format. In the context of white label crypto exchanges, effective data visualization can:

Track Market Trends:

Visualize price movements, trading volumes, and market sentiment to identify trends and opportunities for profitable trading strategies.

Monitor User Activity:

Track user behavior, transaction patterns, and liquidity flows to detect anomalies, prevent fraud, and enhance platform security.

Provide Real-time Insights:

Create interactive dashboards and visualizations that enable users to monitor market conditions, manage their portfolios, and make informed trading decisions in real-time.

Conclusion

In the dynamic and rapidly evolving landscape of white label crypto exchanges, big data analytics and data visualization emerge as indispensable tools for unlocking insights, mitigating risks, and enhancing user experiences. By employing strategies and technologies for handling and analyzing large volumes of data, coupled with effective data visualization techniques, these platforms can empower users to navigate the complexities of the cryptocurrency market with confidence and clarity. As we continue to harness the power of big data analytics and visualization, let us illuminate the path to innovation and prosperity in the realm of digital finance.

Ready to take your cryptocurrency trading to the next level?

Our tokenomics consulting services provide expert guidance to help you navigate the challenges of the crypto market and maximize your profits. From mastering risk management techniques to leveraging advanced tools like sentiment analysis, our team is here to support you every step of the way. Don’t let market tendencies dictate your success—partner with us and gain the knowledge and strategies you need to thrive in the world of crypto trading.

Contact us today to learn more and elevate your trading game!