Business and technology are always evolving, with technology playing an integral part in shaping its landscape. SaaS companies have emerged as key drivers of transformational change, revolutionizing how we access and utilize software solutions. In fact, as of 2023, the SaaS space is worth over $195 billion, underscoring its pivotal role in shaping the world of modern technology.

SaaS companies, with their subscription-based revenue models, have changed the face of the tech industry forever. Offering flexibility, scalability, and accessibility never before seen, these subscription-based businesses have revolutionized tech in an unprecedented way. Due to its explosive growth rate, it is imperative to tailor traditional approaches of valuation accordingly to account for this unique dynamic of these businesses.

This blog post delves into the emerging trends in SaaS business valuation techniques, exploring factors that differentiate SaaS businesses from traditional enterprises as well as innovative techniques used to establish their worth. Understanding these constantly-evolving valuation techniques is vital if you want to successfully navigate the ever-evolving SaaS industry landscape.

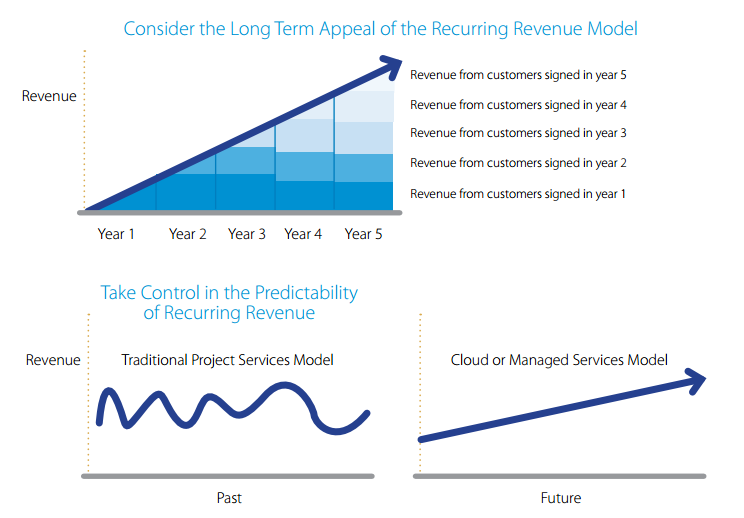

Recurring Revenue Models

SaaS businesses stand out from traditional businesses due to their subscription-based revenue model. Instead of depending on one-off sales for revenue generation, SaaS businesses create ongoing income through monthly or annual subscription fees. This characteristic requires a fundamental shift in how we evaluate their worth. When it comes to SaaS business valuation, the focus has shifted to metrics like Customer Lifetime Value (CLTV) ratio, Net Promoter Score (NPS) benchmark and churn rates.

CLTV quantifies the total expected revenue a company can generate from a single customer throughout its entire relationship with the business. On the flip side, the churn rate represents the percentage of customers who cancel their subscriptions.

In the world of SaaS valuation, these metrics are essential. Investors and analysts meticulously analyze them as they directly impact a SaaS company’s valuation. The calculation involves a deeper understanding of recurring revenue dynamics, allowing for a more accurate assessment of a company’s potential growth and stability.

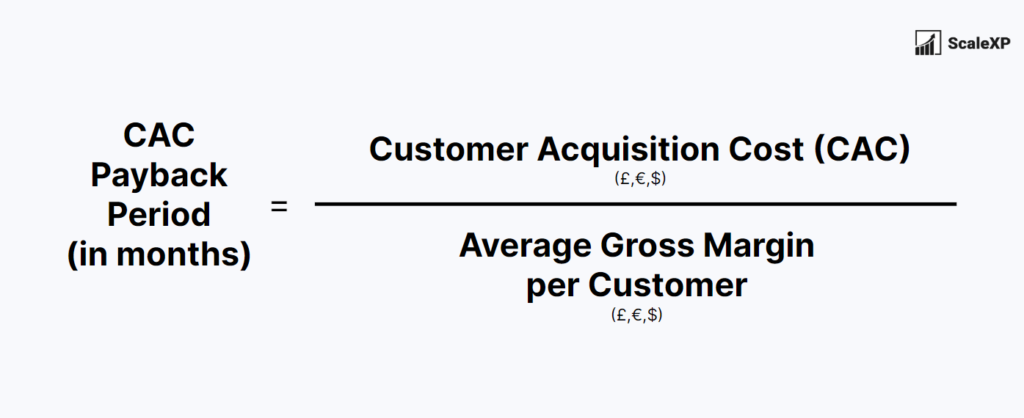

Customer Acquisition Cost (CAC) and Payback Period

SaaS companies are familiar with customer acquisition. However, the dynamics are different than traditional businesses. Customer Acquisition Cost, including expenses related to sales and marketing efforts, plays an integral part in SaaS valuation. Equally as significant is Payback Period which measures how quickly SaaS firms recoup their CAC through customer subscription fees.

In the valuation of SaaS businesses, a shorter Payback Period has become a sought-after trait as it indicates that a company can swiftly recoup its initial customer acquisition investment, reducing the inherent risk associated with long payback periods. This efficiency in customer acquisition not only reflects positively on the company’s financial health but also contributes to a higher valuation.

Unit Economics

Unit economics are rapidly gaining prominence as a key component of SaaS business valuation. Economic analysis involves determining the profitability of each customer or subscription. Metrics like Average Revenue Per User (ARPU), gross margin, and operating costs per user are used to gauge a SaaS company’s sustainability and scalability of its business model.

Positive unit economics, wherein revenue generated from each customer exceeds costs associated with serving them, is an indicator of a healthy and viable business. Companies exhibiting robust unit economics are often viewed as more valuable and less risky, which ultimately translates to higher valuations in the eyes of investors and potential buyers.

SaaS Metrics and KPIs

Key Performance Indicators play an essential part in measuring the performance and value of a SaaS company, providing insight into various aspects of its business. Key SaaS metrics include Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), Customer Acquisition Cost to Customer Lifetime Value ratio, Net Promoter Score (NPS), Churn Rate, and Gross Margin.

MRR is a reflection of a company’s predictable, recurring revenue monthly. ARR, on the other hand, extends this view to an annual scope, aiding in long-term forecasting. The CAC:CLTV ratio determines the efficiency of customer acquisition, NPS measures customer satisfaction and loyalty, churn rate signifies customer retention and gross margin reflects profitability. These KPIs provide investors with a comprehensive view of a company’s current performance and future growth potential.

Market Multiples

A prevalent and practical method for valuing SaaS companies is the use of market multiples. This approach compares a company’s financial metrics against similar publicly traded SaaS businesses.

By looking at metrics such as Price-to-Sales (P/S) ratios, Price-to-Earnings (P/E) ratios, and Enterprise Value Revenue multiples such as Enterprise Value to Revenue multiples investors can gain an understanding of how the market perceives a company’s worth. Market multiples provide comparative viewpoints to benchmark a SaaS business against similar enterprises within an industry.

In Closing

The valuation of SaaS businesses is undergoing a transformative shift, aligning with the unique characteristics of the industry. Recurring revenue models, customer acquisition efficiency, unit economics, and an array of SaaS-specific KPIs have become focal points in assessing the true worth of these companies.

Market multiples further provide valuable insights by comparing SaaS businesses to their peers. As the SaaS sector continues to evolve, staying attuned to these emerging trends in valuation techniques is crucial for investors, entrepreneurs, and industry stakeholders seeking to navigate this dynamic and burgeoning market.