In today’s digital environment, customer-face authentication has proven to be a powerful tool for businesses to increase security, build trust and prevent fraudulent activity. Thanks to advances in facial recognition technology, businesses can now use facial scanning identity verification systems to remotely verify the identity of clients, ensuring compliance with Know Your Customer (KYC) regulations and protecting against identity theft. Facial authentication systems use sophisticated algorithms and artificial intelligence (AI) to compare a live image or video of an individual’s face with previously taken pictures or government identification documents. This process allows businesses to quickly and accurately verify the identity of their clients. This article will discuss the face authentication concept and explore its various applications and benefits.

KYC Face Verification

Know Your Customer (KYC) regulations require businesses to verify the identity of their clients to prevent money laundering, terrorist financing and other illegal activities. Traditionally, these involved physical document checks and personal verification. However, with the advent of facial authentication technology, businesses can now conduct KYC checks remotely. Facial KYC verification involves capturing a client’s face using a webcam or smartphone camera and comparing it to their government ID, such as a passport or driver’s license. The system analyzes facial features such as the distance between the eyes, the shape of the nose and the contours of the face to determine a match. This process provides a seamless and efficient way to verify a client’s identity while ensuring compliance with regulatory requirements.

Face Verification Services

Facial authentication services are offered by specialized providers who use advanced facial recognition technology to verify the identity of clients. These services typically include the following steps:

1. Face Capture

Clients must capture a live image or video of their face using a device equipped with a camera. This can be done through a web portal, mobile app or embedded software.

2. Liveness Detection

To prevent forgery or the use of static images, face verification services include liveness detection. This involves asking the client to perform specific actions, such as blinking or turning the head, to ensure the presence of a living individual.

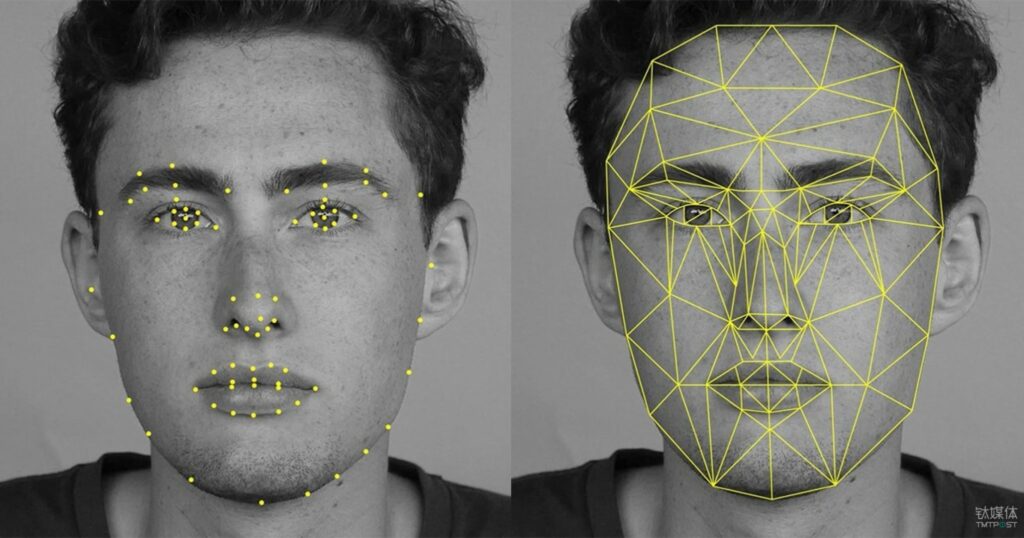

3. Facial Feature Extraction

The captured face image is processed using AI algorithms to extract facial features. These properties are then compared with previously stored images or identification documents.

4. Identity Verification

The face verification system compares the extracted facial features with the client’s reference images or identification documents to determine a match. The system provides a confidence score or decision on the authenticity of the client’s identity.

Face Recognition Solutions

Facial recognition solutions cover a wider range of applications beyond the authentication of client faces. These solutions use face recognition technology to identify individuals based on their unique facial features. Some common applications of facial recognition solutions include:

1. Access control

Facial recognition can be used to securely control access to physical spaces such as office buildings or restricted areas. By scanning the faces of individuals trying to gain access, businesses can ensure that only authorized users have access.

2. Attendance Tracking

Facial recognition systems can automate attendance tracking processes by capturing and verifying the faces of employees or students. This eliminates the need for manual attendance records and provides accurate records.

3. Customer Personalization

Businesses can use face recognition online technology to personalize customer experiences. For example, retail stores can identify returning customers and provide them with customized recommendations or offers based on their previous purchases.

4. Surveillance and Security

Facial recognition solutions are widely used in surveillance systems to identify people in real-time or view recorded footage. This helps in increasing security, identifying suspects and preventing crime.

Advantages of client face verification:

Implementing client-face authentication offers businesses several benefits:

1. Enhanced Security

Face authentication provides an additional layer of security by ensuring that clients are who they say they are. This reduces the risk of ID theft, fraudulent transactions and unauthorized access to sensitive information.

2. Better Compliance

By incorporating facial verification into KYC processes, businesses can more effectively comply with regulatory requirements. Facial verification enables businesses to verify the authenticity of clients’ identities and document their compliance efforts.

3. Simplified Onboarding

Client-face verification simplifies the onboarding process by reducing the need for physical document checks and in-person verification. This reduces the time and effort required to sign up a client and improves the overall user experience.

4. Fraud Prevention

Facial authentication systems help businesses prevent fraudulent activities by accurately verifying the identity of clients. By comparing live images to reference images or identification documents, businesses can detect and prevent identity theft and fraudulent transactions.

5. Cost and time savings

Automated facial verification processes save businesses the time and costs of manual document review and face-to-face verification. The simplified process enables businesses to integrate clients more efficiently, reduce operating costs and accelerate revenue generation.

6. Strengthening trust and reputation:

Implementing robust facial authentication systems demonstrates a commitment to security and compliance. This builds trust and credibility with clients, fosters long-term relationships and improves the company’s reputation.

Conclusion

In conclusion, client-face authentication is a powerful tool for businesses to increase security, build trust, and prevent fraudulent activity. By leveraging facial verification systems and services, businesses can streamline client onboarding, ensure compliance with KYC regulations, prevent identity theft, and build stronger relationships with their clients. Thanks to advances in facial recognition technology, facial authentication solutions offer a reliable and effective method for businesses to verify client identities and protect against fraud.

- What is the F-1 measure and why is it useful for imbalanced class problems?

- From Data Streams to Decentralized Worlds: Exploring the Role of Blockchain Subgraphs in Gaming Infrastructure

- How to predict customer churn using machine learning, data science and survival analysis

- Business models in data science and AI