The integration of artificial intelligence (AI) in trading has been a revolutionary step in the financial sector thanks to its unprecedented speed, efficiency, and data processing capabilities. However, as with any major technological advancement, it comes with its own set of risks. In this article, we will explore the potential dangers of AI in trading and provide practical strategies for using these tools safely.

Understanding AI in Trading

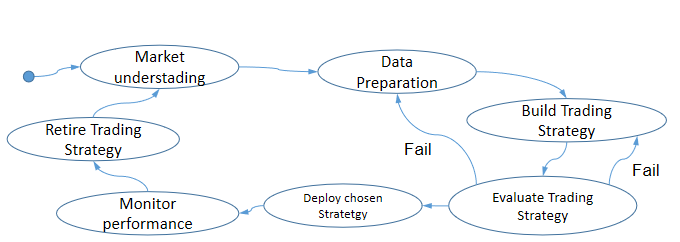

In trading, AI tools use computer algorithms that can analyze large volumes of data, identify market trends, and, in some cases, execute trades automatically, which is one of the advantages of high-frequency trading and robo-advisors. These algorithms are designed to learn from the market’s historical and real-time data, making predictions and decisions at a speed and accuracy beyond human capabilities.

Risks of Using Artificial Intelligence in Trading

As this technology becomes more widely used by different brokers and platforms, it demonstrates significant risks that traders should be aware of. The most important of them include over-reliance on such tools, lack of transparency, market manipulation, and security issues.

- Over-Reliance on Automation

The availability of such tools causes the tendency to become over-reliant on automation. While AI can process and analyze data more efficiently than humans, it cannot understand context or the nuances that can be crucial in decision-making. Over-reliance on AI can lead to a false sense of security, where traders might ignore or underestimate market complexities and external factors that the tool might not have been programmed to consider.

- Lack of Transparency and Understanding

AI trading algorithms are often complex and not easily understandable, even for their creators. This lack of transparency, also known as the “black box” issue, means that traders might not fully understand how decisions are being made. In situations where the market behaves unexpectedly, traders might find it challenging to intervene or override the tool’s decisions due to a lack of understanding of its internal workings.

- Market Manipulation Risks

It also raises concerns about market manipulation. Sophisticated systems might be used to create false market trends or manipulate prices, which can be particularly damaging in less liquid markets. Moreover, AI-driven high-frequency trading can lead to increased volatility, as seen in several flash crashes attributed to algorithmic trading errors – for example, in this 2019 mini-flash crash event.

- Cybersecurity Threats

These systems, like any digital technology, are vulnerable to cybersecurity threats. A breach in a trading AI can lead to significant financial losses, unauthorized access to sensitive market information, and manipulation of trading algorithms. Ensuring the security of these systems is paramount to prevent malicious attacks that could destabilize financial markets.

Strategies for Safe Usage of AI in Trading

To mitigate these risks, traders and institutions need to adopt a cautious and informed approach. Here are some strategies to consider:

- Developing a Strong Understanding

One of the first steps is to understand how AI trading algorithms work. This does not necessarily mean mastering the technical details, but having a solid grasp of the principles, capabilities, and limitations of the systems in use. This knowledge enables traders to make more informed decisions about when to rely on AI and when to intervene manually.

- Implementing Checks and Balances

It is crucial to implement checks and balances within AI trading systems. This can include setting up risk limits, stop-loss orders, and other safeguards to prevent significant losses. Regularly monitoring and reviewing AI decisions and outcomes is also essential to ensure that the algorithms are performing as intended and not causing unintended market disruptions.

- Strategy Diversification

Diversification remains a key principle in trading, and this applies to AI trading as well. Relying solely on these tools for all trading decisions can be risky. Combining them with traditional strategies and human judgment can create a more balanced and resilient approach.

- Prioritizing Cybersecurity

Given the digital nature of AI trading, prioritizing cybersecurity is non-negotiable. This includes regular updates and audits of the systems, implementing strong encryption methods, and having robust protocols to respond to any security breaches. Safeguarding against cyber threats is crucial to protect not just financial assets but also the integrity of the algorithms.

- Ethical and Regulatory Compliance

As these systems can operate with a level of autonomy, ensuring that they operate within ethical boundaries and regulatory frameworks is essential. This includes compliance with market fairness and transparency rules, as well as data privacy regulations. Traders and firms should also be aware of evolving regulations to avoid legal and reputational risks.

- Continuous Learning and Adaptation

The financial market is dynamic, and AI systems, no matter how advanced, can become outdated. Continuous learning and adaptation are key to staying relevant. This involves updating models regularly with new data, refining machine learning algorithms based on market changes, and being open to integrating new advancements. Additionally, it is crucial to understand that this technology is not infallible and to remain vigilant for signs of model decay or errors.

- Collaboration Between AI and Human Expertise

A collaborative approach between the tools and human expertise often yields the best results. Human traders can provide insights that artificial intelligence cannot, such as understanding socio-political events or interpreting subtle market sentiments. Conversely, AI can handle vast amounts of data and execute trades with precision and speed. A symbiotic relationship where the tools complement human decision-making can lead to more effective trades.

- Crisis Management and Scenario Planning

AI systems can react unfavorably in unprecedented situations or market crises. Therefore, having a crisis management plan in place is crucial. This includes scenario planning for different market conditions and having protocols for swiftly intervening or shutting down operations if they start behaving erratically or exacerbating market volatility.

- Encouraging Transparency and Accountability

Promoting transparency and accountability can help in mitigating risks. This means having clear documentation of how the algorithms are designed, their decision-making processes, and their limitations. Transparent practices not only build trust but also aid in diagnosing and rectifying issues swiftly when they arise.

Conclusion

The integration of AI in trading has opened new frontiers in financial markets, offering opportunities for enhanced efficiency and profitability. However, it also brings significant risks that need to be carefully managed.

Traders can successfully and safely use artificial intelligence in their strategies if they understand the risks and plan out a balanced approach that combines the use of these tools and their own human expertise. Reliable security measures, regulatory compliance, and respect for ethical standards are also important. The future of trading with AI looks promising, but it requires a diligent and thoughtful approach to navigate safely and successfully.