Financial data is a valuable asset for organizations. It’s also highly regulated — companies must take steps to ensure that this data is effectively protected from potential threats. Despite best efforts, however, compromises occur. Recent research found that between June 2018 and June 2022, more than 150 million financial records were compromised.

While no security solution is impervious, there are steps that businesses can take to reduce their total risk and improve overall financial protection. One of the most powerful, which has generated significant interest over the past few years, is artificial intelligence (AI).

Here’s a look at how AI can help companies avoid common threats and keep financial data safe.

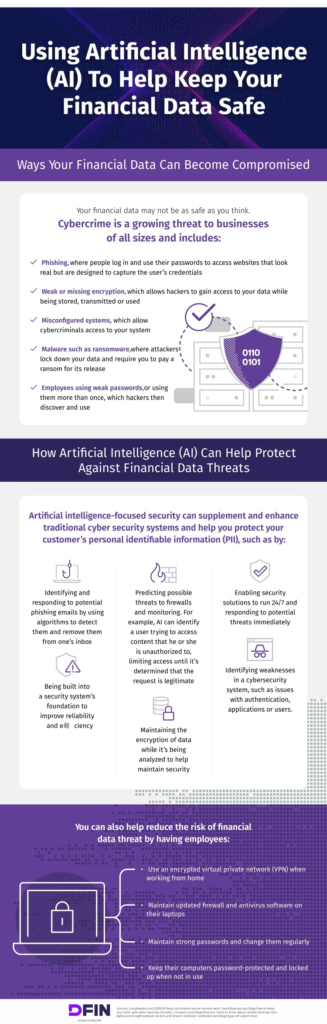

How Financial Data Is Commonly Compromised

Malicious actors aren’t picky about their potential targets. Some choose smaller firms because these companies may have limited IT security resources, while others go after multinational enterprises in an effort to exfiltrate large amounts of valuable data.

Regardless of their targets, attackers employ several common methods to gain access and compromise data. These include:

Phishing

Phishing remains one of the most popular compromise methods because it works. Staff receive legitimate-looking emails that include malicious attachments or contain links to malware-infected sites.

Malware

One popular form of malware is ransomware. If attackers can infiltrate company systems and download ransomware payloads, they can encrypt financial data and demand payment for its release.

In addition, malicious actors may also take advantage of common security missteps, such as:

Weak Passwords

With passwords such as “password” and “123456” still common, attackers can often gain network access in a few simple steps. First, they find an employee’s email address and input it in username fields, then try one of several common passwords. It works all too often.

Misconfigured Systems

Systems that are misconfigured also pose a risk. For example, if passwords and usernames are set to their default value or error messages display sensitive information, financial data may be compromised.

Missing Encryption

Absent or weak encryption makes it possible for attackers to view financial data in transit and exfiltrate it for their own purposes.

How AI Helps Keep Financial Data Safe

Artificial intelligence solutions excel at finding patterns. Underpinned by machine learning (ML) algorithms, AI tools can both pinpoint problematic patterns of behavior and improve their ability to detect patterns over time.

Consider an AI solution trained to detect odd user behavior such as logins outside of business hours or the transfer of multiple large-volume files in quick succession. With exposure to enough behavioral data, along with information about the responses taken by IT teams, this solution could learn to incorporate other behaviors — such as login attempts from new geographical areas or rapid, successful logins across multiple services — as part of the overall security scanning process.

In practice, AI is most effective as a supplement to existing security programs. Some popular applications include the identification of phishing attacks, the discovery of potential system weaknesses and the prediction of possible threats.

Avoiding the Hook

AI tools can be trained to detect the common characteristics of phishing emails and automatically prevent them from reaching user inboxes. If they’re already past perimeter defenses, AI tools can delete messages before they are opened.

Strengthening Key Systems

By deploying AI tools across internal systems, companies can identify previously unknown weaknesses. These may include issues with authentication that allow users to bypass key security controls or problems with applications that permit access to source code.

Anticipating Issues

AI can also be used to predict potential problems before they happen. For example, tools can detect users attempting to access content from an odd location or at an odd time, then limit their access until requests are deemed legitimate, or terminate the session if not.

In addition, AI frameworks can compile current threat data to scan networks for indicators of compromise, such as a sudden uptick in the number of access requests, which may indicate a distributed denial-of-service (DDoS) attack.

Work Smarter, Not Harder

AI makes it possible for companies to improve threat detection, response and remediation, in turn reducing the risk of financial data compromise and loss.

While AI isn’t a silver bullet — businesses need to consider how AI best aligns with current practices and regularly evaluate its efficacy to ensure tools scale with emerging demand — it offers a way to work smarter, not harder in the fight for financial data security.

For more information on AI and its implications in the financial security world, see the accompanying resource.

Infographic Created By DFIN