Introduction: The importance of token emissions

In the rush to try out new and untested ideas, a clear pattern has shown up: many crypto projects prefer to copy successful plans, systems, and strategies from those that came before them. While showing that some methods work, this habit also highlights how careful many projects are when moving through the complicated world of token economies.

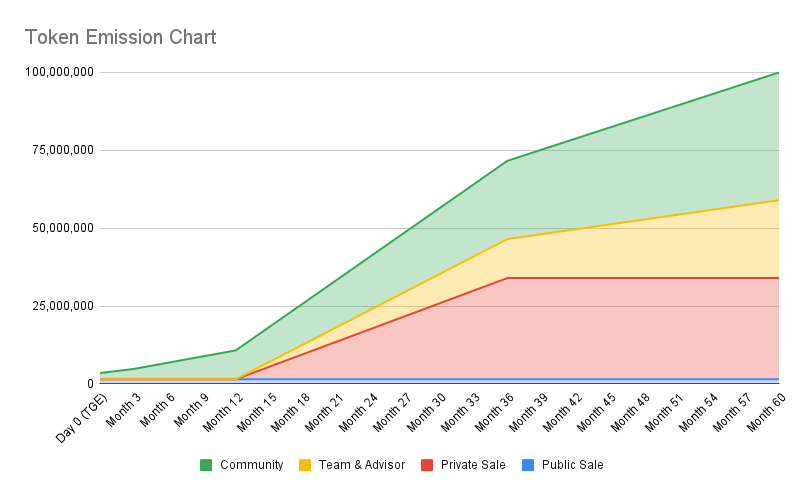

One clear example of this pattern is seen in how crypto projects set up their token release plans and locking periods. Many new crypto projects choose a straightforward monthly plan where tokens are given out in equal parts each month. This method is popular because it’s easy to set up and understand, and it gives a reliable schedule for investors, developers, and users.

The main reason so many projects use this monthly plan is that it helps control how many tokens are released at a time. By doing this, it stops too many tokens from hitting the market suddenly, which could lower the token’s price. Also, it makes sure that the project’s team and its investors are on the same page, offering a slow distribution that encourages everyone to stay involved and support the project over time.

Pitfalls of Linear Emissions in Token Economies

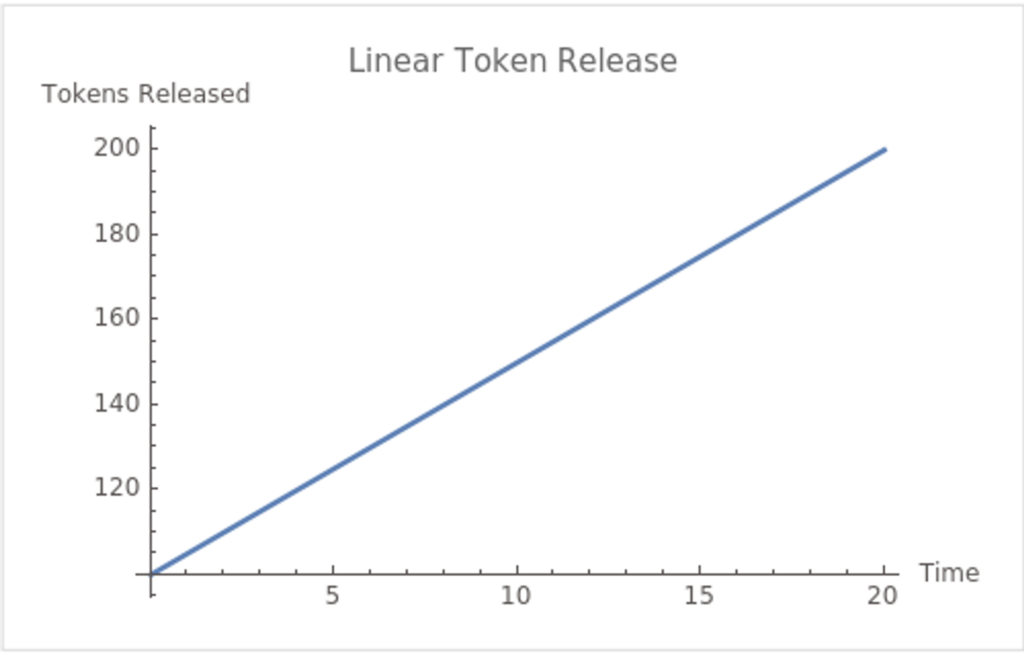

For new projects, the temptation to adopt a tried-and-tested formula is understandable. Linear monthly vesting schedules, where tokens are released at a constant rate over a predetermined period, are favored for their simplicity and predictability. This method provides a straightforward framework for managing the supply of tokens, but it is not perfect.

- Lack of Innovation: Relying heavily on established practices can stifle innovation. Crypto projects that do not explore unique or improved tokenomics models may miss out on opportunities to better align incentives or create more sustainable economic designs.

- Misalignment with Project Goals: Linear vesting schedules, while straightforward, may not always align with the specific needs or long-term objectives of a project. For instance, a project with a longer development timeline might benefit from a more gradual release of tokens to better match its progress and milestones.

- Lack of Adaptability: Linear monthly vesting schedules are rigid and do not allow for adjustments based on the project’s performance, market conditions, or strategic shifts. This inflexibility can prevent projects from responding effectively to unforeseen challenges or capitalizing on new opportunities, potentially affecting their long-term success.

Fixed, but more Fitting?

Early-stage crypto startups are particularly vulnerable and susceptible to pump-and-dump schemes shortly after their launch. During these initial stages, they often find themselves in need of a greater number of tokens for various purposes. After the growth stage, the project still in need of long-tail emission to incentivize specific user actions.

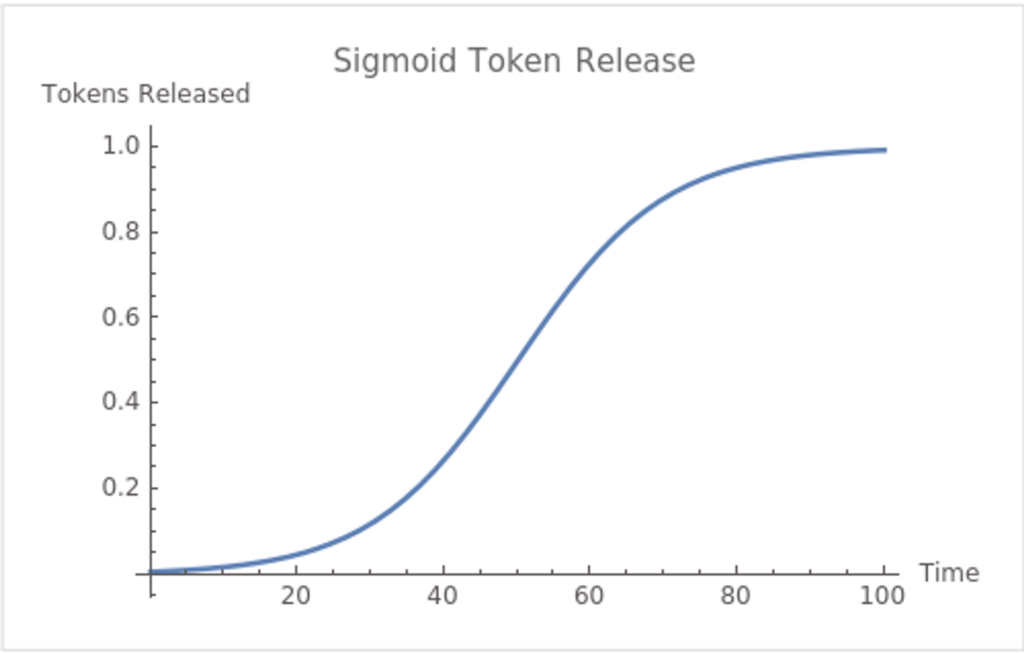

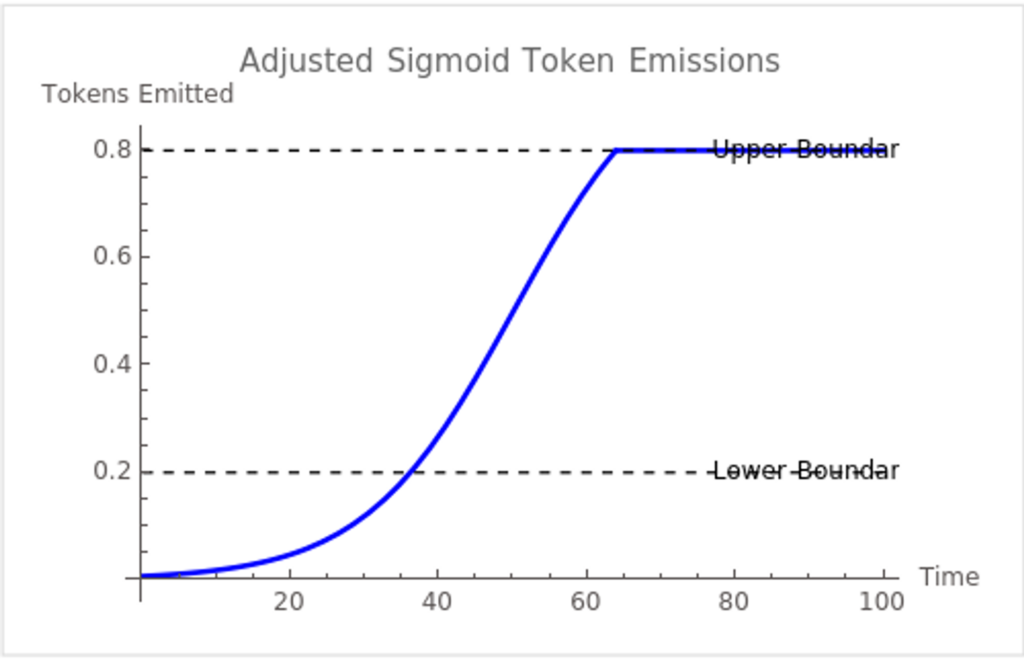

A linear release schedule often proves inadequate because many projects experience significantly high inflation right from the start, at a time when they are most susceptible. However, we can introduce a funky S-shaped curve that ticks all these boxes.

We can observe that a sigmoid curve strategically mitigates inflation during the project’s vulnerable early stages and allocates the majority of token releases to the growth phase, precisely when the project requires the most tokens.

It’s still not dynamic and adaptable, but it is much more suitable for early-stage crypto startups for the aforementioned reasons. Additionally, it can be optimized to release tokens in specific cycles. Project teams can attempt to release significantly more tokens in euphoric markets and flatten the inflation rate in bear markets.

Other Token Emission Curves

Other curves can be tailored to specific goals, such as incentivizing early adoption, managing inflation, or aligning token supply with project development milestones. The choice of the curve depends on the economic behaviors the token economy aims to encourage or control. Therefore, there isn’t a one-size-fits-all solution; it should be optimized for a specific project or solution.

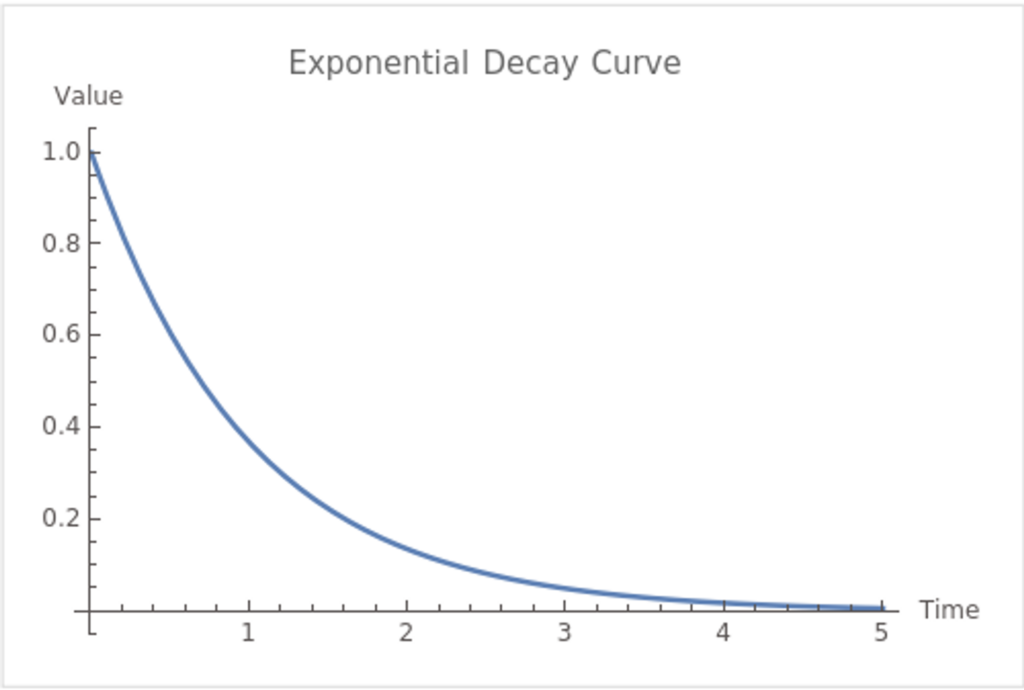

Exponential Decay Curve

This model starts with a high emission rate that decreases exponentially over time. It’s useful for projects that want to reward early participants more generously but plan to decrease the reward rate over time to control inflation.

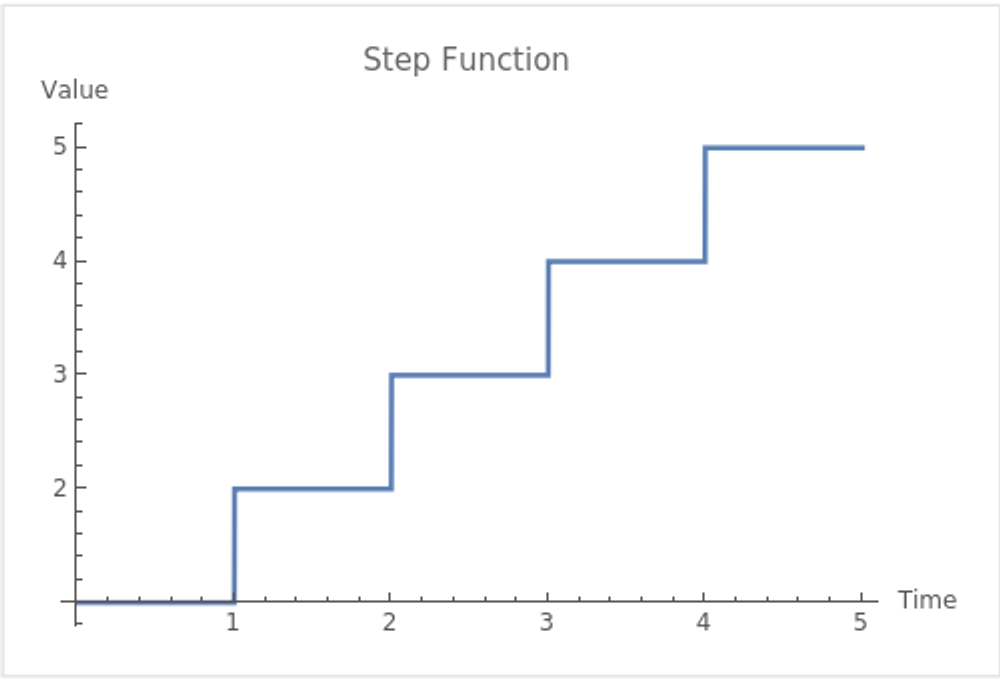

Step Function

A step function can be used to create discrete phases in the token emission schedule, where each phase has a constant emission rate.

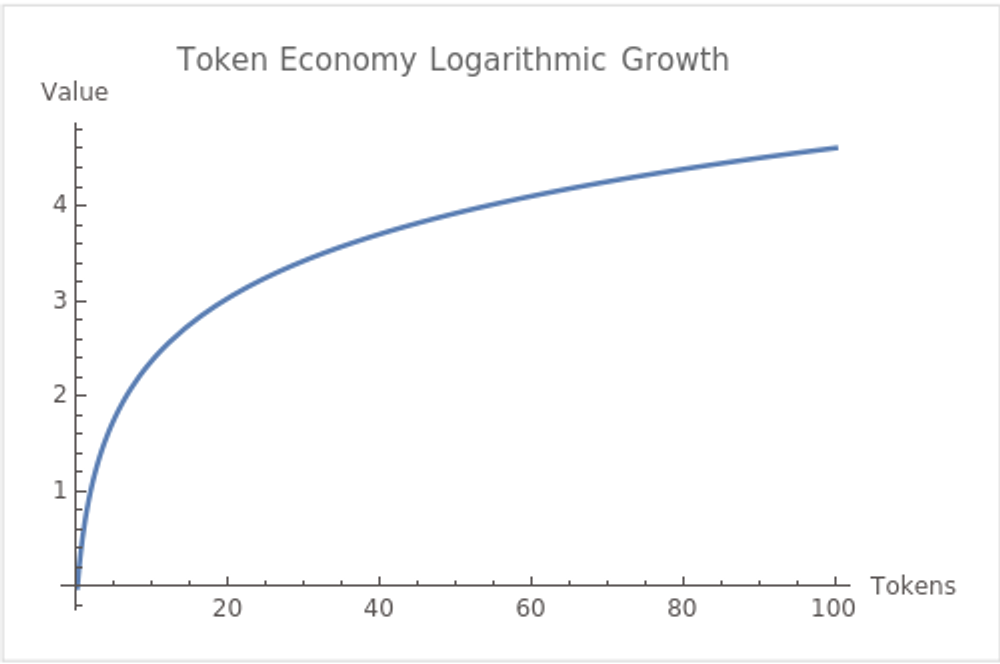

Logarithmic Curve

A logarithmic emission curve starts aggressively but quickly flattens out.

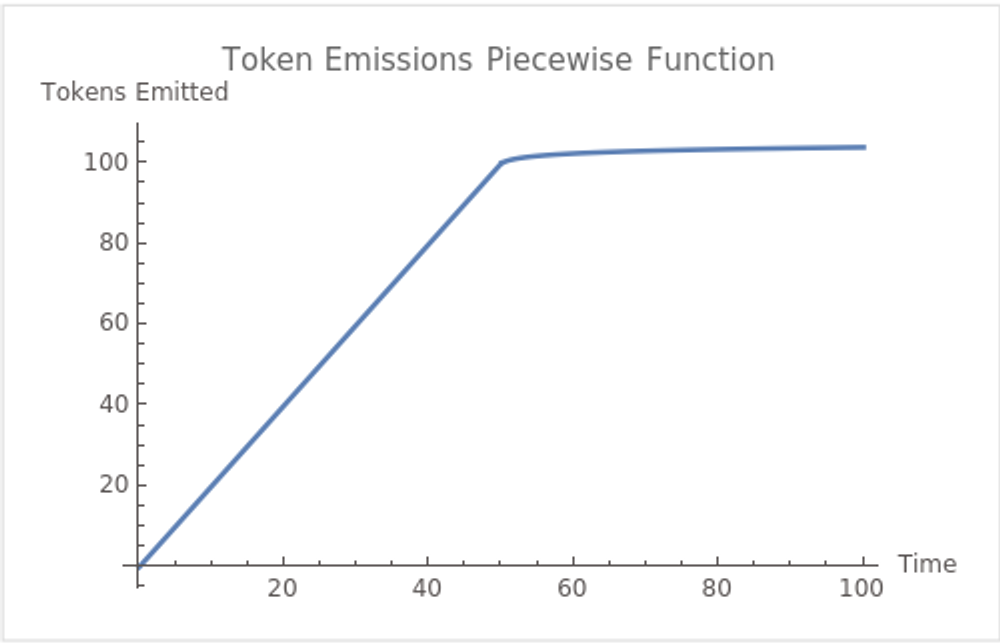

Piecewise Function

Combining different types of functions for different periods can tailor the emission schedule to specific needs. For example, a project might start with a linear function for initial aggressive growth, switch to an exponential decay for sustainability, and end with a flat line as it reaches a maximum cap.

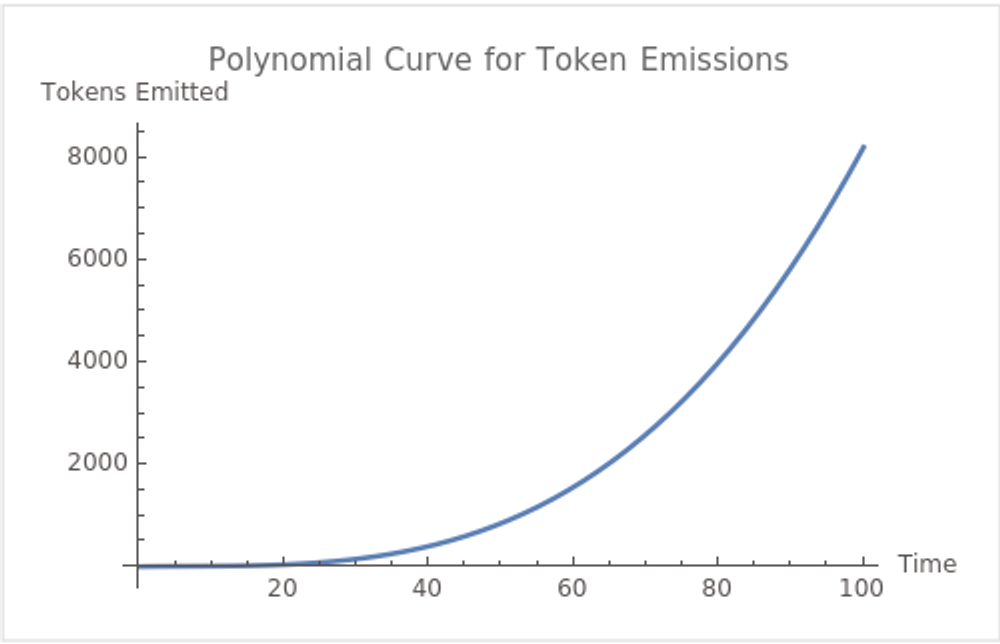

Polynomial Curve

These curves can be designed to have multiple peaks or to adjust the emission rate in a more complex manner than simple exponential or linear models.

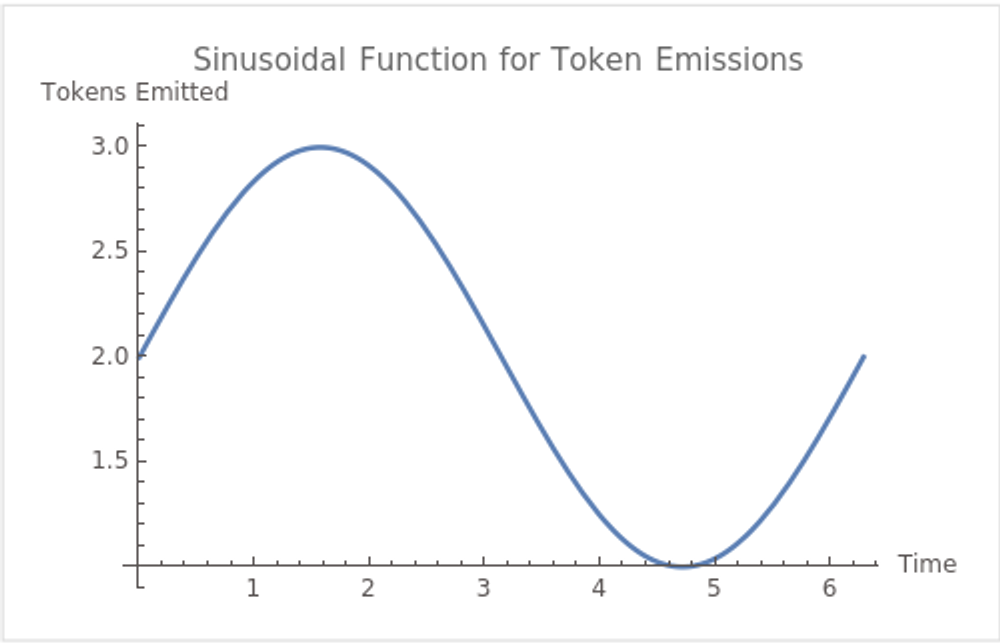

Sinusoidal Function

Sinusoidal functions could be used to model cyclical token emissions, which might align with periodic events or seasons in the project’s ecosystem.

Dynamic Token Emission

We have a great variety to choose from and play with, but they are still, umm… fixed. We can introduce dynamic mechanisms and establish boundaries for how the curve can change.

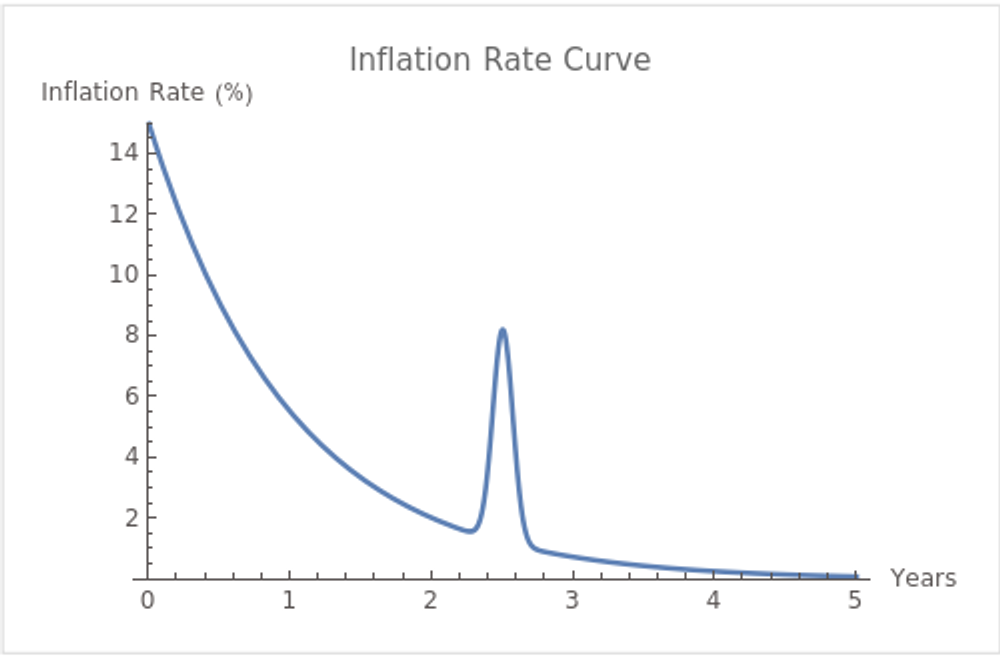

To adapt the emissions based on dynamic activity/mechanisms (economic activity), you can introduce dynamic boundaries that adjust the parameters of the sigmoid function. These boundaries could be defined by economic indicators such as market volume, token price stability, or user activity levels. Whereas:

- Upper Boundary: The maximum emission rate, set during periods of high economic activity.

- Lower Boundary: A reduced emission rate, triggered during economic downturns.

The key to making the sigmoid function dynamic is adjusting its parameters based on real-time economic indicators. For instance:

- In a Bull Market: You might increase the total number of tokens emitted, reflecting increased demand and economic activity.

- In a Bear Market: Reduce the total emissions, conserving the token supply in response to decreased demand.

Summary: From Emissions to Tokenomics Success

In this article we went through the common practice of crypto projects adopting linear monthly token release plans and highlights their limitations. We introduced the concept of alternative token emission curves which provides better control of inflation and allocation of tokens for growth phases, particularly suited for early-stage startups.

Me and my team are more than happy to help you design and audit your token economy.

We are also using TokenLab to experiment with and simulate various token emission scenarios and identify the most optimal one.

Tokenlab is a library for simulating token economies based on agent-based models. It abides by the following principles:

- Modularity: The different components can be merged as the user sees fit.

- Explicitness: The assumptions behind the different modules are stated clearly, as well as any limitations.

- Intermediate-level-of-abstraction: TokenLab is focused on simulating the actions of aggregate groups of agents (e.g. a certain user cohort), instead of individuals.

- Focus on the economy: TokenLab’s tools are focused on answering questions about a token economy and performing things such as stress tests.

- Flexibility: TokenLab is designed in a way that it offers maximum flexibility to those who desire it. It can support logical flows, or arbitrary mechanisms within its simulations, for any kind of agent action.

About the author

Linas is a tokenomics researcher at Hacken, with a background in cryptocurrency and fintech consultancy. Having worked on over 20 projects, his expertise in economic design is showcased in his published work on tokenomics audit procedures. Linas melds his industry experience with structural analysis and a focus on risk assessment to assist crypto startups in building robust, sustainable economies.